Several Impacts of Policy Changes on Debt Financing Instruments of Non-financial Enterprises on Legal Opinions

![]() Loading...

Loading...

![]() 2021.04.06

2021.04.06

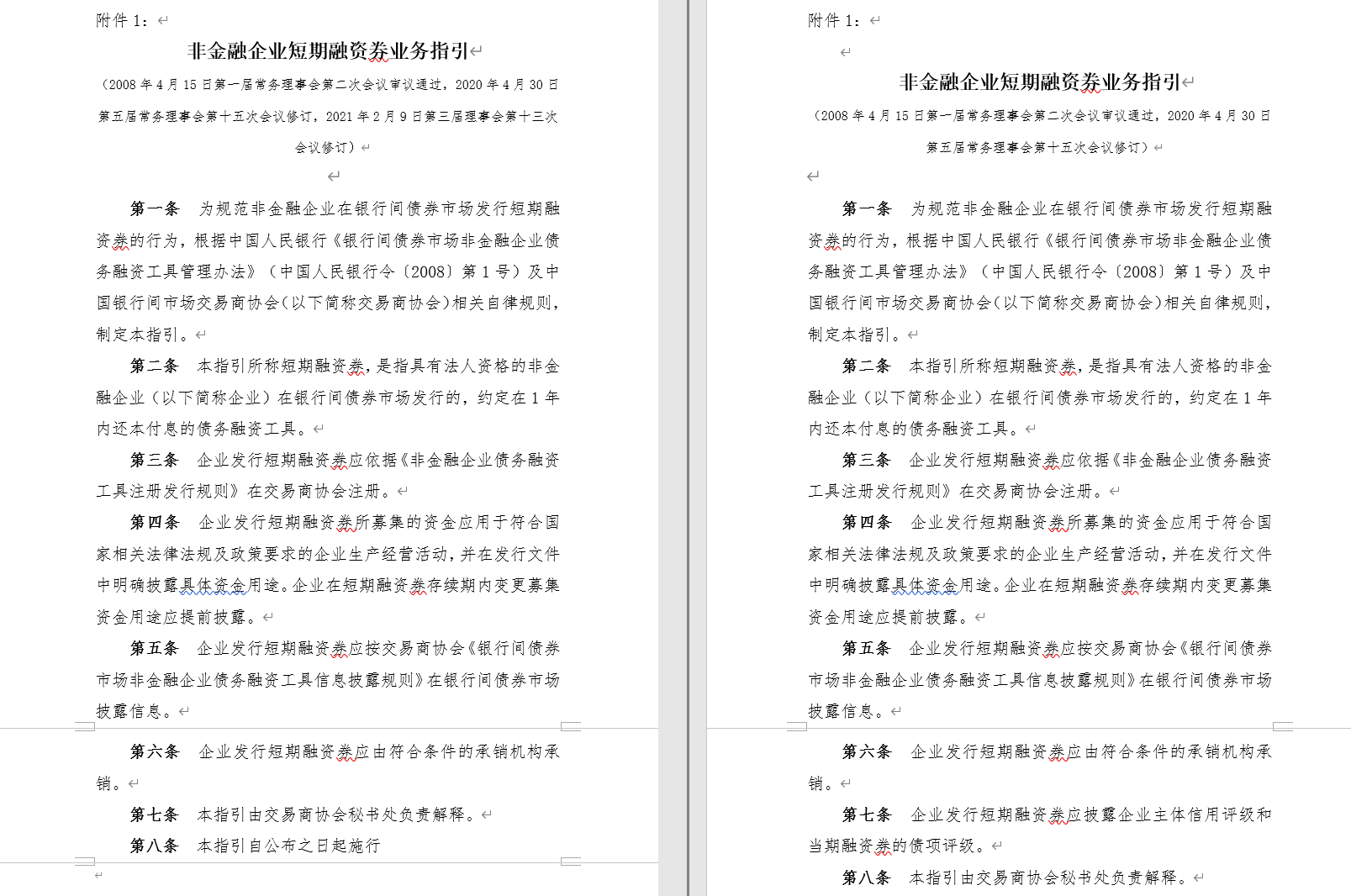

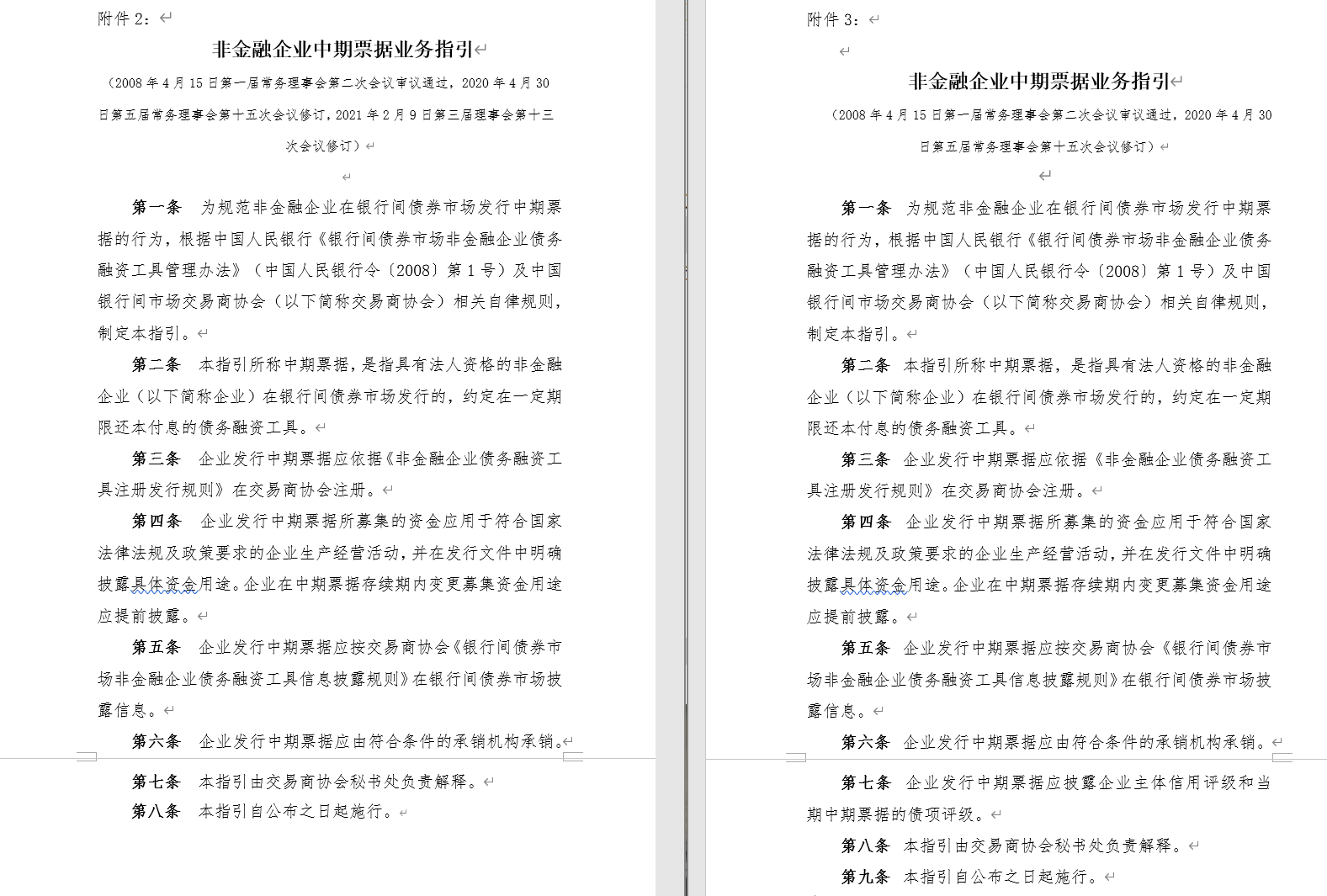

Since April 16, 2020, the China Association of Interbank Market Dealers (hereinafter referred to as the "Dealers Association") announced the "Non-Financial Corporate Debt Financing Instruments Public Offering Registration Document Form System (2020 Edition)" and the "Non-Financial Corporate Debt Financing Instruments Targeted Issuance Registration Document Form System (2020 Edition)", in the past year, the Association of Dealers has successively promulgated and implemented the above-mentioned form system, 2020 and 2021 versions of the "Non-Financial Enterprise Short-term Financing Bond Business Guidelines", "Non-Financial Enterprise Ultra-short-term Financing Bond Business Guidelines", "Non-Financial Enterprise Medium-term Note Business Guidelines", "Non-financial Enterprise Debt Financing Instrument Prospectus Investor Protection Mechanism Model Text" and "Announcement on the Implementation of Arrangements Related to Cancellation of Securities Service Business Qualifications of Accounting Firms" notice of Arrangements and other documents, the promulgation and implementation of these policy documents has a substantial impact on the scope of verification by the issuer's lawyers and the content system of the legal opinion, which is summarized in this paper as follows:

On April 16, 2020, in order to further strengthen the standardization and orderly conduct of registration and issuance by intermediaries such as enterprises and lead underwriters, the Dealers Association issued the "Non-financial Corporate Debt Financing Instrument Public Offering Registration Document System (2020 Edition)" (hereinafter referred to as "Public Form (2020 Edition)") and "Non-financial Corporate Debt Financing Instrument Targeted Issuance Registration Document System (2020 Edition)" (hereinafter referred to as "Targeted Form (2020 Edition)"), and made notices and explanations on matters related to the publication and implementation of the document. According to the "Notice on Announcement and Implementation of

1. Public Offering and Form F

For publicly issued debt financing instruments, the Association of Dealers, prior to the publication of the Public Form (2020 Edition), had issued the "Non-Financial Corporate Debt Financing Instruments Public Offering Registration Document System (2019 Edition)" on April 12, 2019 (hereinafter referred to as "Public Form (2019 Edition)"); the contents and differences between the Public Form (2020 Edition) and the Public Form (2019 Edition) in the Legal Opinion Disclosure Form (Form F) are shown in the following table:

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: The matters covered by the blue background in the form are the information disclosure points modified or added by the Public Form (2020 Edition) to the Public Form (2019 Edition); the matters covered by the red background in the form are the information disclosure points deleted by the Public Form (2020 Edition) to the Public Form (2019 Edition).

As can be seen from the above table, compared with the old F table, the new F table has the following changes:

((1) Removal of disclosure and verification requirements for outstanding balances of debt financing instruments

The new Form F removes the F-4-1 disclosure point in the old Form F: registration or filing amount-whether the pending balance of the debt facility after the registration or issuance of the current debt facility meets the requirements of the rule guidelines. As a result, the issuer's counsel may no longer verify and express an opinion as to whether the outstanding balance of the relevant debt facility exceeds 40% of the issuer's net assets. (For details, please refer to Part II of this article, "Delete the provision that the balance to be repaid shall not exceed 40% of the net assets of the enterprise")

Compared to the old Form F, the new Form F adds a F-4-8 disclosure point that requires verification and an opinion on the issuer's surviving bonds, I .e., the fact that the issuer has defaulted on or delayed payment of principal and interest on debt facilities or other debt issued remains in a continuing state. Therefore, the issuer's lawyer should verify and express an opinion on the existence and payment of the debt financing instruments or other debt that the issuer has issued.

(3) Verification of new investor protection related content

Compared to the old Form F, the new Form F adds a new F-5-1 to the F-5-4 information disclosure point, requiring verification and comment on matters such as the fiduciary management of debt financing instruments, the rules of holders' meetings, the disposal of default risk in the prospectus, and investor protection provisions. Therefore, the issuer's lawyers should verify the entrusted management of debt financing instruments in accordance with the "Model Text of Investor Protection Mechanism in the Prospectus of Non-financial Corporate Debt Financing Instruments", "Business Guidelines for Trustees of Non-financial Corporate Debt Financing Instruments (Trial)" and its supporting systems, "Notice on Transitional Arrangements for the Business Guidelines for Trustees of Non-financial Corporate Debt Financing Instruments", "Knowledge on Filing Matters Related to Trustee Management Business" and other documents, holders meeting rules, default risk disposal, investor protection provisions in the prospectus and express opinions.

For targeted issuance of debt financing instruments, the Association of Dealers issued the "Non-Financial Corporate Debt Financing Instruments Registration Document Form System (2017 Edition)" on September 1, 2017 before issuing the "Targeted Form (2020 Edition)" (hereinafter referred to as "Targeted Form (2017 Edition)"); the contents and differences between the Directed Form (2020 Edition) and the Directed Form (2017 Edition) in the Directed Issue Legal Opinion Disclosure Form (DF Form) are shown in the following table:

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: The matters covered by the blue background in the form are the information disclosure points modified or added by the Orientation Form (2020 Edition) to the Orientation Form (2017 Edition); the matters covered by the red background in the form are the information disclosure points deleted by the Orientation Form (2020 Edition) to the Orientation Form (2017 Edition).

As can be seen from the above table, compared with the old DF table, the new DF table has the following changes:

(1) Delete the DF-1-5 information disclosure point in the old DF table.

The new DF table deletes the DF-1-5 information disclosure point in the old DF table: whether it exists in accordance with the law, that is, whether the issuer should be terminated in accordance with laws, regulations, regulatory documents and articles of association.

(2) Verification of new trustees

The new DF table adds the DF-3-6 information disclosure point: whether the trustee has the relevant qualifications and whether there is an association with the issuer. Therefore, the issuer's lawyer should verify and express an opinion on the trustee's situation of the targeted debt financing instrument.

The addition of this information disclosure point is due to the fact that on December 27, 2019, the Association of Dealers issued the "Business Guidelines for Trustees of Debt Financing Instruments of Non-Financial Enterprises (Trial)" (hereinafter referred to as the "Business Guidelines for Trustee Management") and its supporting system "Notice on the" Business Guidelines for Trustees of Debt Financing Instruments of Non-Financial Enterprises "(hereinafter referred to as the" Notice of Transitional Arrangements ")") "the know, mandatory engagement of trustees is provided for, as described in the section" Mandatory engagement of trustees and transitional arrangements for 5. "of this article.

(3) Verification of new credit enhancement agencies

Compared with the information disclosure point DF-4-7 the old DF table, the information disclosure point in the new DF table adds a new verification content: if the credit enhancement is provided by a professional credit enhancement institution, it is necessary to express an opinion on whether the bond guarantee liability balance and the concentration index of the registered issuer are in compliance. Therefore, if the targeted debt financing instrument is provided by a professional credit enhancement agency, the issuer's lawyer should increase the verification and comment on the balance of the bond guarantee liability under the name of the professional credit enhancement agency and the issuer concentration of the guaranteed bonds.

(4) Verification of the surviving debt of the new issuer

Compared to the old DF table, the new DF table adds a F-4-8 information disclosure point, which requires verification of the issuer's surviving bonds and an opinion on whether the issuer has defaulted on or delayed payment of principal and interest on the debt financing instruments or other debt issued, which is still in a continuing state. Therefore, the issuer's lawyer should verify and express an opinion on the existence and payment of the debt financing instruments or other debt that the issuer has issued.

(5) Verification of new investor protection related content

Compared to the old DF table, the new DF table adds a DF-5-1 to the F-5-4 disclosure point, requiring the issuer's lawyer to verify and comment on matters such as the fiduciary management of the debt financing instrument, the rules of the holders' meeting, the disposal of default risk, and the investor protection clause.

To sum up, in view of the fact that the Public Form (2020 version) and the Orientation Form (2020 version) are the basic guidelines for submitting the application materials for the registration and issuance of debt financing instruments of non-financial enterprises to the dealers association, the above changes in the information disclosure forms of legal opinions on public issuance and directional issuance will make substantial changes in the verification scope and matters of the issuer's lawyers, naturally, the system of legal opinions should also be structured according to the information disclosure form of legal opinions for public issuance and directional issuance. Regardless of public issuance or directional issuance, the content of the legal opinion shall at least include six parts: statement matters, issuing subject, issuing procedures, issuing documents and relevant institutions, major legal matters and potential legal risks related to this issuance, and investor protection.

In 2016, the Association of Dealers promulgated the Guidelines for the Business of Medium-term Notes for Non-Financial Enterprises (2016 Edition), in which Article 4 stipulates that enterprises issuing medium-term notes shall comply with relevant national laws and regulations, and the outstanding balance of medium-term notes shall not exceed 40% of the net assets of the enterprise. However, in the Guidelines for the Business of Medium-Term Notes for Non-Financial Enterprises (2020 Edition) and the Guidelines for the Business of Medium-Term Notes for Non-Financial Enterprises (2021 Edition) promulgated in 2020 and 2021, the provision that "the outstanding balance of medium-term notes shall not exceed 40% of the net assets of the enterprise" has been deleted.

Similarly, in 2016, the Association of Dealers promulgated the Guidelines for the Business of Short-term Financing Bonds for Non-Financial Enterprises (2016 Edition), in which Article 4 stipulates that enterprises issuing short-term financing bonds shall comply with relevant national laws and regulations, and the outstanding balance of short-term financing bonds shall not exceed 40% of the net assets of the enterprise. However, the Guidelines for the Business of Short-term Financing Bills for Non-Financial Enterprises (2020 Edition) and the Guidelines for the Business of Short-term Financing Bills for Non-Financial Enterprises (2021 Edition) promulgated in 2020 and 2021 have deleted the provision that "the outstanding balance of short-term financing bills shall not exceed 40% of the net assets of the enterprise.

Compared with the "Securities Law" promulgated and implemented in 2014 (hereinafter referred to as the "original" Securities Law "), the" Securities Law "passed in 2019 and implemented in March 2020 (hereinafter referred to as the" New "Securities Law") The (II) item of the first paragraph of Article 16 of the original Securities Law, "For public issuance of corporate bonds, the cumulative bond balance shall not exceed 40% of the company's net assets"; the author believes that, the Guidelines for the Business of Medium-term Notes for Non-Financial Enterprises (2020 Edition), the Guidelines for the Business of Medium-term Notes for Non-Financial Enterprises (2021 Edition), the Guidelines for the Business of Short-term Financing Bonds for Non-Financial Enterprises (2020 Edition) and the Guidelines for the Business of Short-term Financing Bonds for Non-Financial Enterprises (2021 Edition) issued in 2020 and 2021 delete the words "the outstanding balance of medium-term notes shall not exceed 40% of the net assets of the enterprise net assets". 40% "rule, it is a response to the revision of the Securities Law and is also based on the consideration of unifying the basic issuance conditions of debt financing instruments in the interbank bond market and other bond markets.

As mentioned in the first part of this article, "Information Disclosure Form of Legal Opinion and Content System of Legal Opinion", in order to adapt to the changes in the issuance conditions of relevant debt financing instruments in the above business guidelines, the information disclosure points in the new Form F have also been adjusted accordingly, and the F-4-1 information disclosure points in the old Form F have been deleted (registration or filing amount-after the current debt financing instruments have been registered or issued, whether the outstanding balance of debt financing instruments meets the requirements of the rules). Therefore, for medium-term notes and short-term financing bills, under the new business guidelines, legal opinions may no longer verify and express an opinion on whether the outstanding balance of the issuer's medium-term notes or short-term financing bills exceeds 40% of the issuer's net assets.

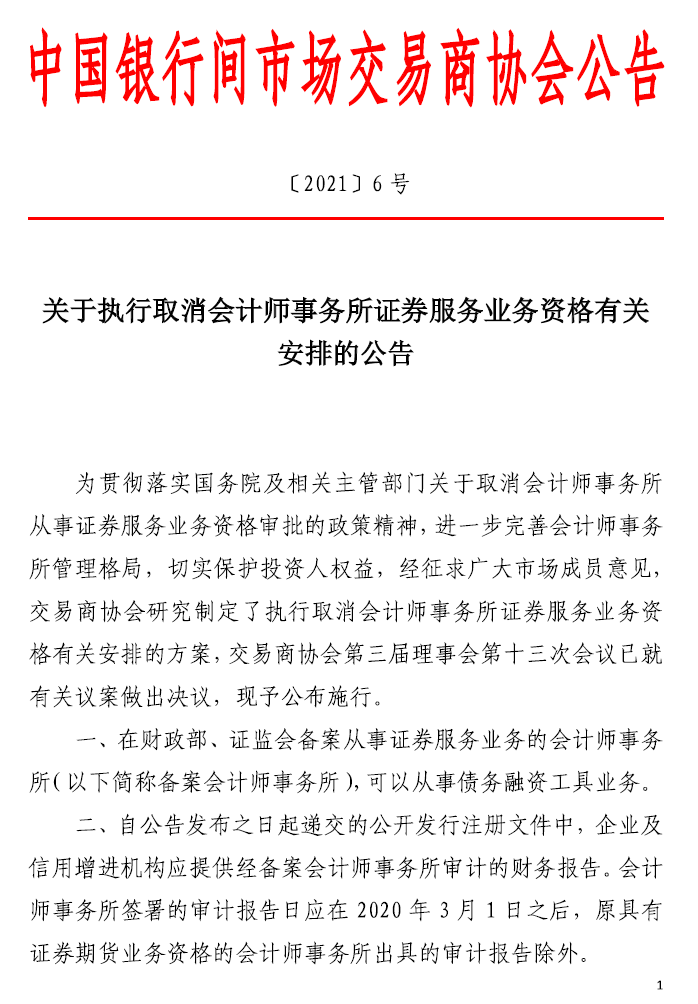

On February 26, 2021, the Association of Dealers announced the document "Announcement on the Implementation of Arrangements Related to the Cancellation of Accounting Firms' Qualifications for Securities Service Business"; among them, Article 1 stipulates that accounting firms that engage in securities service business on record with the Ministry of Finance and the CSRC may engage in the business of debt financing instruments. Article 2 stipulates that in the public offering registration documents submitted from the date of the announcement, enterprises and credit enhancement institutions shall provide financial reports audited by the record accounting firm. Article 4 stipulates that issuers of debt financing instruments and credit enhancement institutions may independently choose accounting firms for auditing, encourage the selection of record-keeping accounting firms, and indicate in the directional issuance documents whether the audit institutions engage in securities service business to the Ministry of Finance and the CSRC for the record. Article 5 stipulates that accounting firms engaged in the business of debt financing instruments shall be subject to the self-discipline management of the association.

Therefore, according to the provisions of the above announcement, when verifying the audit institution qualification of relevant debt financing instruments according to the information disclosure point F-3-4 in the new Form F and the information disclosure point DF-3-3 in the Form DF, the issuer's lawyer shall carry out the following verification:(1) For publicly issued debt financing instruments, the issuer's lawyer shall verify whether the audit institution has filed with the Ministry of Finance and the Securities Regulatory Commission for engaging in securities service business, whether to accept the self-regulation of the Association of Dealers and issue a legal opinion. (2) For debt financing instruments issued in a targeted manner, if the audit institution is a registered accounting firm, the issuer's lawyer shall verify whether the audit institution has filed with the Ministry of Finance and the China Securities Regulatory Commission for engaging in securities service business, and whether it accepts the self-discipline management of the dealers' association And express legal opinions; if the audit institution is an accounting firm that has not filed, the issuer's lawyer shall make it clear in the legal opinion that the auditor has not filed with the Ministry of Finance and the CSRC in respect of engaging in securities services, and shall also express a legal opinion on whether the auditor accepts the self-regulatory management of the dealers' association.

On March 26, 2021, the Association of Dealers issued a Notice on the Implementation of Arrangements Related to the Cancellation of Mandatory Rating of Debt Financing Instruments (Zhongshi Xiefa [2021] No. 42, hereinafter referred to as the "Cancellation Notice"), and the Cancellation Notice made the following arrangements:

In accordance with the above provisions of the Cancellation Notice, the following adjustments may be made to the opinion of the legal opinion regarding the issuer's subject and debt rating:

(1) According to Article 1 of the Notice of Cancellation of Rating, the rating report is no longer a necessary material for declaration during the registration process. Therefore, if the issuer fails to submit a rating report during the registration stage, the issuer's lawyer shall check the credit rating agency. Since there is no credit rating and credit rating agency, the verification and legal opinions shall be exempted, but it may be necessary to explain that the issuer has not submitted a rating report during this registration.

(2) In accordance with Article 2 of the Notice of Cancellation of Rating, at the issuance stage, the mandatory disclosure requirement for debt rating reports is abolished (there is no situation in which the debt rating is lower than the subject's rating due to the inferior payment of the principal and interest of the debt), and the disclosure requirement for the subject rating report of the enterprise is retained. This means that even if there is no situation that the debt rating is lower than the main rating due to the inferior payment of the principal and interest of the debt, the issuer still needs to employ a credit rating agency to rate the main body and issue a rating report in the issuance process. Therefore, when issuing legal opinions for the issuer to issue debt financing instruments for non-financial enterprises, the issuer's lawyers still have to check and express their opinions on the issuer's rating and rating agencies.

On March 26, 2021, the 2021 version of the Guidelines for the Business of Short-Term Financing Bills for Non-Financial Enterprises and the Guidelines for the Business of Medium-Term Notes for Non-Financial Enterprises published by the Association of Dealers also removed the requirements for ratings in the 2020 version.

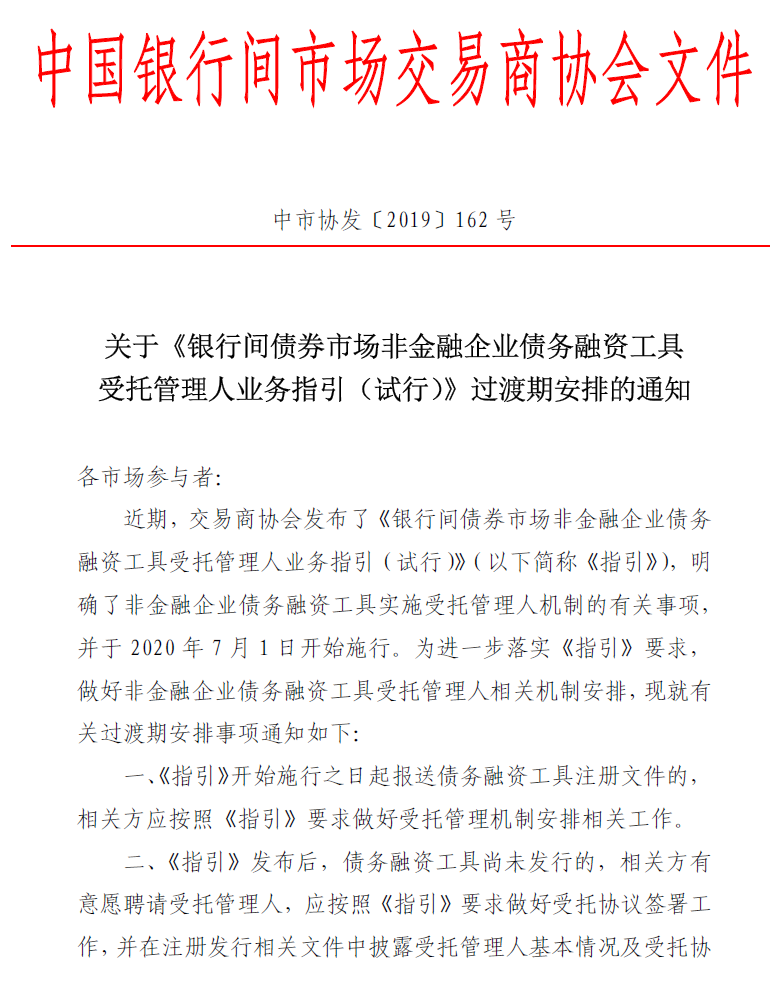

According to the F-5-2 information disclosure point provisions in the new Form F and DF, the legal opinion shall express a legal opinion on whether the appointment of the trustee, the object of the fiduciary management agreement, the content of the agreement, the conditions for entry into force, etc. comply with laws and regulations, normative documents and self-regulatory rules, and whether they are legal and effective.

On December 27, 2019, the Association of Dealers issued the "Business Guidelines for Trustees of Non-financial Corporate Debt Financing Instruments (Trial)" (hereinafter referred to as the "Guidelines for Trustee Management Business") and its supporting system "Regarding the

Article 2 of the Guidelines for Entrusted Management Business stipulates that in the case of issuing debt financing instruments, the issuer shall employ a trustee for the holders of debt financing instruments, and sign a debt financing instrument entrusted management agreement (hereinafter referred to as the "trustee agreement") with the successful issuance as the only effective condition before the registration and issuance.

For the appointment of a trustee and the implementation of the Fiduciary Management Business Guidelines, the Association of Dealers has set up a transitional period, which, according to the Notice of Transitional Arrangements, is set up as follows:

1. If the registration documents of debt financing instruments are submitted from the date of the implementation of the Guidelines on Trustee Management, the relevant parties shall do a good job in arranging the relevant work of the trustee management mechanism in accordance with the requirements of the Guidelines.

2. After the issuance of the Guidelines on Entrusted Management Business, if the debt financing instrument has not yet been issued, and the relevant parties are willing to engage the trustee, they shall do a good job in signing the trustee agreement in accordance with the requirements of the Guidelines, and disclose the basic information of the trustee and the main contents of the trustee agreement in the relevant documents for registration and issuance.

3. After the issuance of the Guidelines on Fiduciary Management, if the debt financing instrument is already in its duration and the relevant party is willing to engage a trustee, a trustee that meets the requirements may be selected by resolution of the holders' meeting.

Therefore, according to the above provisions and arrangements,(1) if the issuer submits an application for registration after July 1, 2020, it shall employ a trustee for the debt financing instrument, and the issuer's lawyer shall, according to the requirements of the new form f and DF, check and express opinions on the qualification of the trustee, the legality and validity of the trustee management agreement, and the prospectus on whether the trustee management agreement discloses relevant information on the trustee management;(2) If after July 1, 2020, the debt financing instrument has been registered but not yet issued, or has been issued and is in the duration, the relevant party may decide to appoint a trustee. If the relevant party elects a trustee at the time of issuance, the issuer's lawyer shall issue a legal opinion for the debt financing instrument in accordance with the requirements of the new Form F and Form DF, verify and express opinions on the qualifications of the trustee, the legality and validity of the trustee management agreement, and the prospectus on whether the trustee management agreement discloses information related to the trustee management.

The above views are my interpretation of the policy document based on project practice and do not represent the positions and views of the Dealers Association and other institutions.

—————————————— Introduction to the Author ———————————————