Comments on the revised points of "Several Provisions on Cases of Misrepresentation"

Loading...

Loading...

2022.01.24

2022.01.24

On January 21, 2022, the Supreme People's Court issued the "Several Provisions of the Supreme People's Court on the Trial of Civil Compensation Cases concerning the Infringement of False Statements in the Securities Market" (hereinafter referred to as the "Provisions" 2022), which will come into force on January 22, 2022. 2022 "Regulations" are the "Notice of the Supreme People's Court on Issues Concerning the Acceptance of Civil Tort Disputes Caused by False Statements in the Securities Market" (implemented on January 15, 2002, hereinafter referred to as "the" Notice "of 2002") and "Several Provisions of the Supreme People's Court on the Trial of Civil Compensation Cases Caused by False Statements in the Securities Market" (implemented on February 1, 2003, hereinafter referred to as the "Regulations of the 2003").

This paper will be combined with practice, the 2022 of the provisions of the major amendments to the content of the assessment.

1. The content and structure of the 2022 "Regulations" are greatly adjusted.

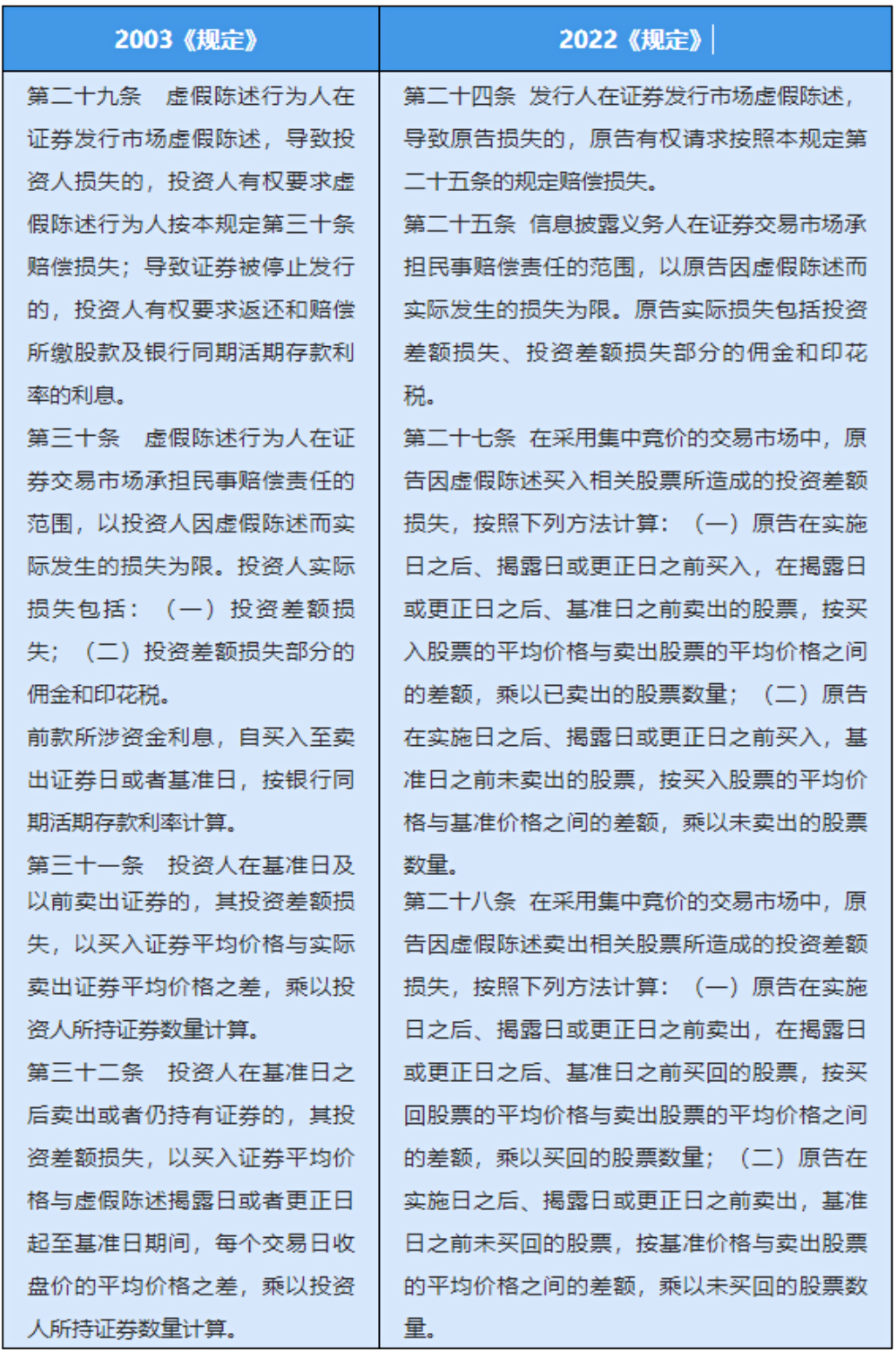

2003 The Provisions are divided into eight chapters: "General Provisions", "Acceptance and Jurisdiction", "Litigation Methods", "Determination of False Statements", "Imputation and Exemption of Liability", "Joint Tort Liability", "Determination of Loss" and "Supplementary Provisions, the 2022" Regulations "are divided into" general provisions "," determination of false statements "," material and transaction causality "," fault determination "," responsible subject "," loss determination "," statute of limitations ", and" supplementary provisions "Eight chapters.

2022 "provisions" chapter content and structural adjustment is mainly as follows:

1.2003 the "General Provisions" and "Acceptance and Jurisdiction" chapters in the "Provisions", some of them are merged into the "General Provisions" chapter by the 2022 "Provisions", some are included as the new "Responsible Subject" chapter, and some are included in the new "Limitation of Action" chapter after being deleted and integrated with the relevant content in the 2002 "Notice;

2.The 2022 Provisions have deleted the chapter on "Methods of Litigation" from the 2003 Provisions, mainly because the relevant content is already in the current Civil Procedure Law and the Provisions of the Supreme People's Court on Several Issues Concerning the Litigation of Securities Disputes by Representatives;

3. 2003 the provisions of the "imputation and exemption" chapter content, part of the adjustment to 2022 the provisions of the "fault" chapter, part of the "responsibility of the main body" chapter;

4. 2022 the provisions of the new "material and transaction causality" section, and the 2003 provisions of the "false statement" section of the causality of the content of the separation;

5. 2022 "provisions" on the "identification of false statements" chapter content has been greatly adjusted.

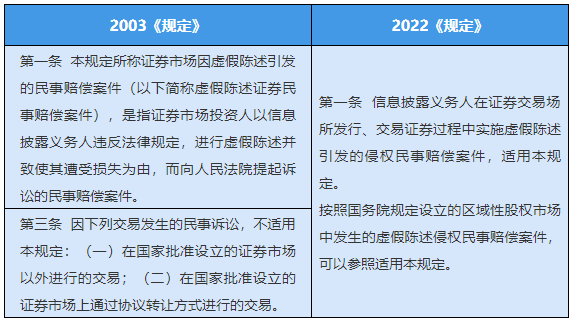

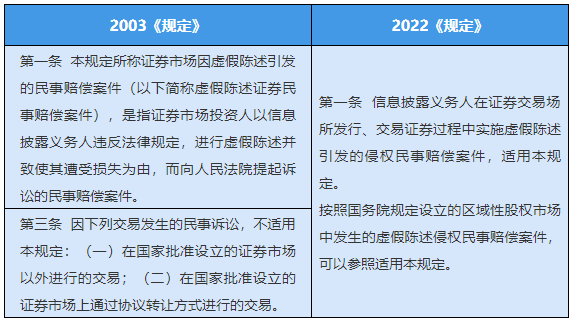

2. Expanding the scope of application of the 2022 Provisions

(I) Expanded Scope of Application to Investors

Mainly reflected in two aspects. First, the 2022 Provisions may be applied to cases of infringement of false statements by information disclosure obligors in securities trading venues and in regional equity markets established in accordance with the provisions of the State Council. Second, if an investor suffers losses as a result of "over-the-counter transactions" or "agreement transfer transactions", the 2022 Regulations may also apply. The 2003 "Regulations" exclude the application of claims for losses suffered by special investors due to "over-the-counter transactions" and "agreement transfer transactions". This is because the 2003 "Regulations" determine the relationship between the information disclosure obligor's false statements and the loss results of ordinary investors. When the causal relationship, the principle of presumption of trust is followed, and the burden of proof of causality is reversed, and the system is mainly to protect small and medium investors. After the 2022 Provisions reconstruct the rules of causality proof, the above exclusion is no longer necessary.

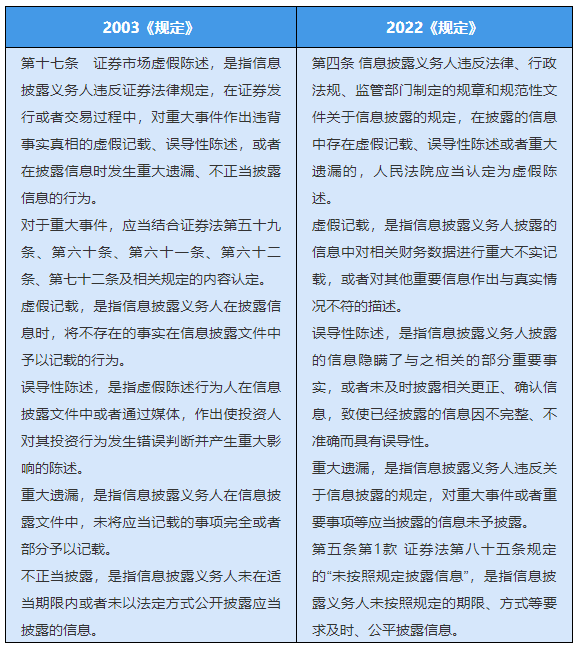

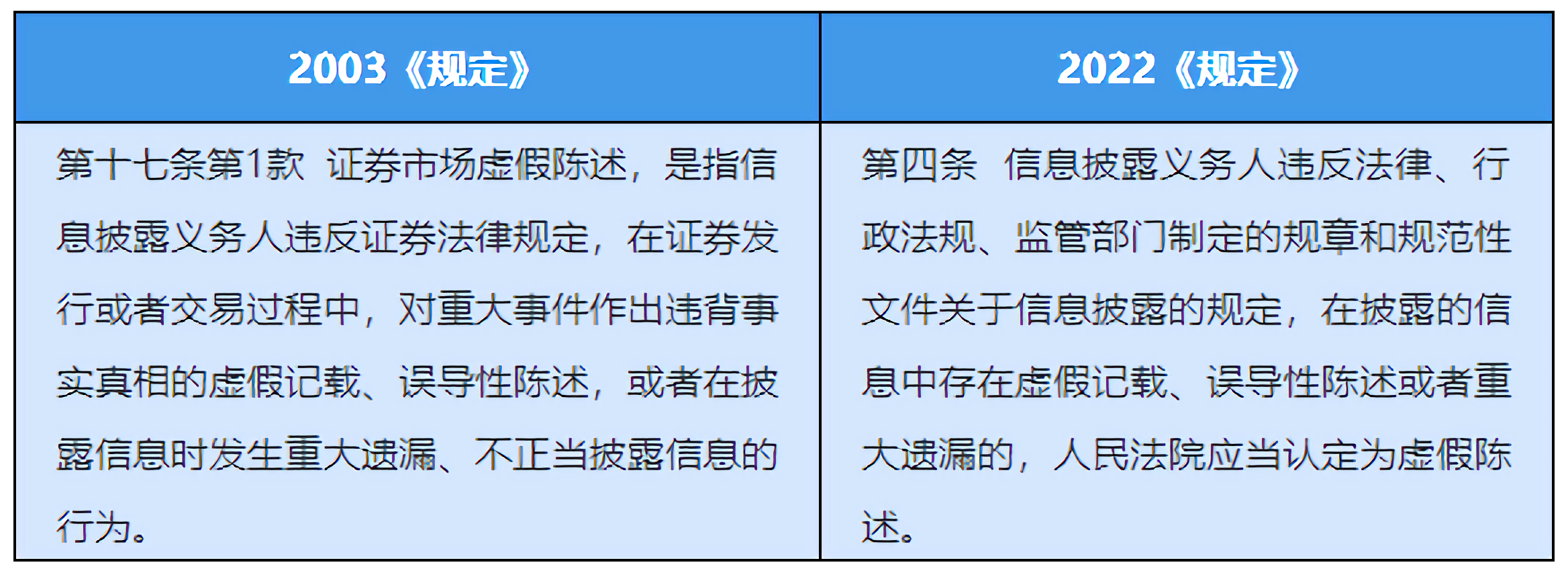

(II) Expansion of the scope of the basis for the determination of false statements

The basis for determining false statements is the "provisions of securities laws" in 2003, while the "provisions" in 2022 are the "provisions of laws, administrative regulations, rules and normative documents formulated by regulatory authorities on information disclosure", which has been greatly expanded and the requirements for information disclosure by issuers have been significantly increased.

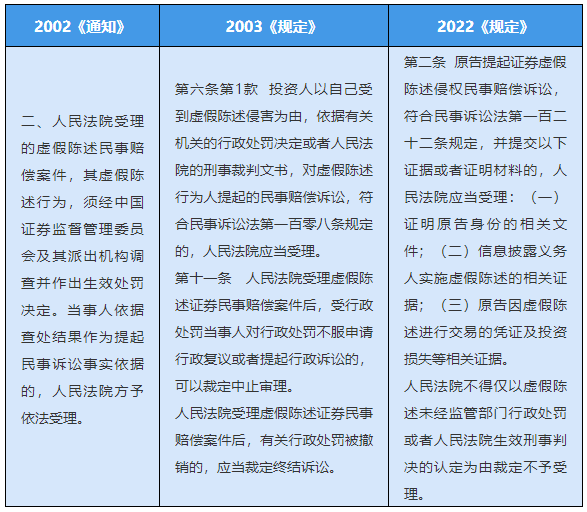

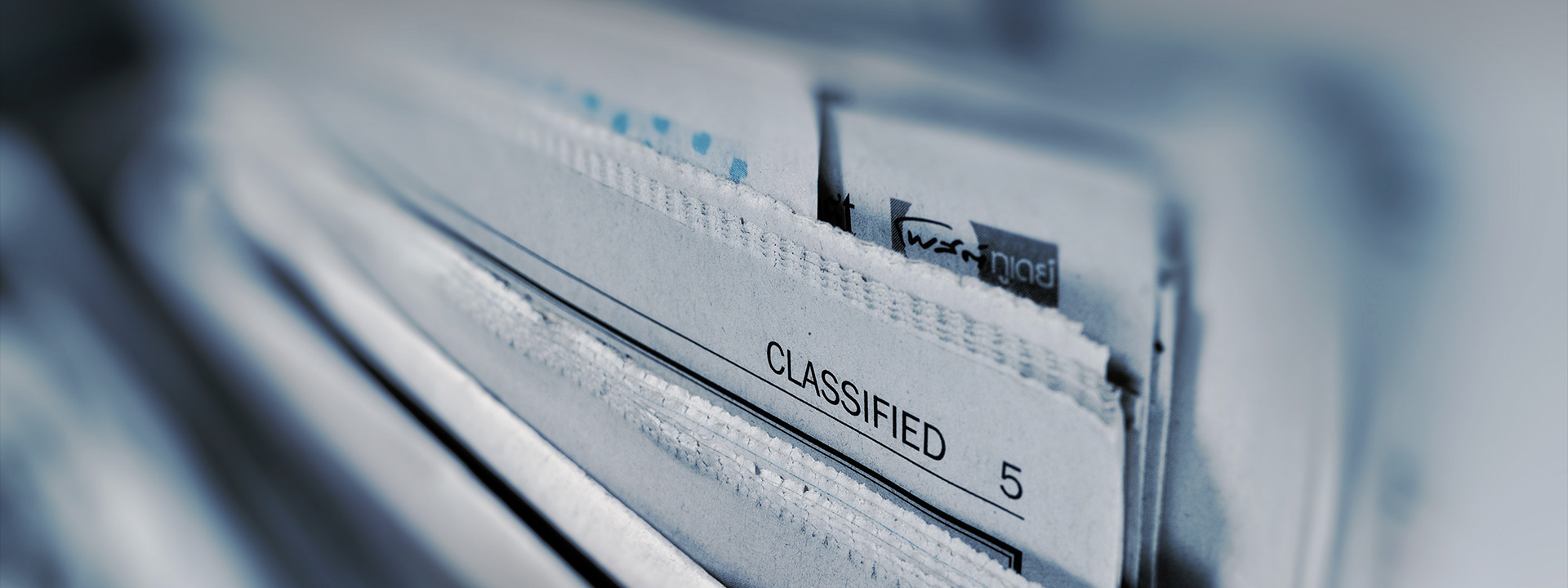

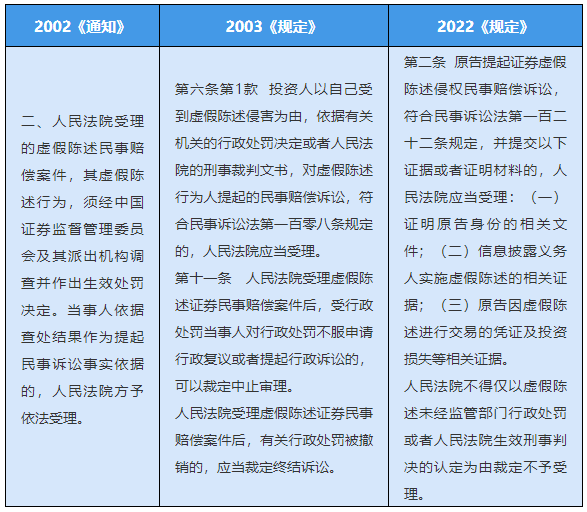

3. Abolition of pre-litigation procedure

2002 both the Notice and the 2003 Provisions require that investors must submit an administrative penalty decision or announcement against the information disclosure obligor, or a criminal judgment document of the people's court, to file a civil compensation lawsuit for misrepresentation of securities. In recent years, however, there have been signs of a dilution of the pre-procedural requirements in practice. For example, in the 2019 investor lawsuit against Lianjian Optoelectronics Securities for misrepresentation, when the case was filed, the Shenzhen Intermediate People's Court still required the plaintiff to submit an administrative penalty decision or announcement against the information disclosure obligor to file the case. In the process of civil litigation, Lianjian Optoelectronics refused to accept the ''Administrative Penalty Decision'' made by the Shenzhen Regulatory Bureau of the China Securities Regulatory Commission, filed a reconsideration in accordance with the law, and then filed a first-instance and second-instance administrative litigation. Before the ruling, the Shenzhen Intermediate People's Court had resumed the trial of a series of civil cases previously suspended in December 2020 and made a ruling in May 2021.

2022 The Provisions explicitly eliminate the pre-litigation procedure and reduce the requirements for investors to sue, the litigation rights of damaged investors can be protected in a timely manner.

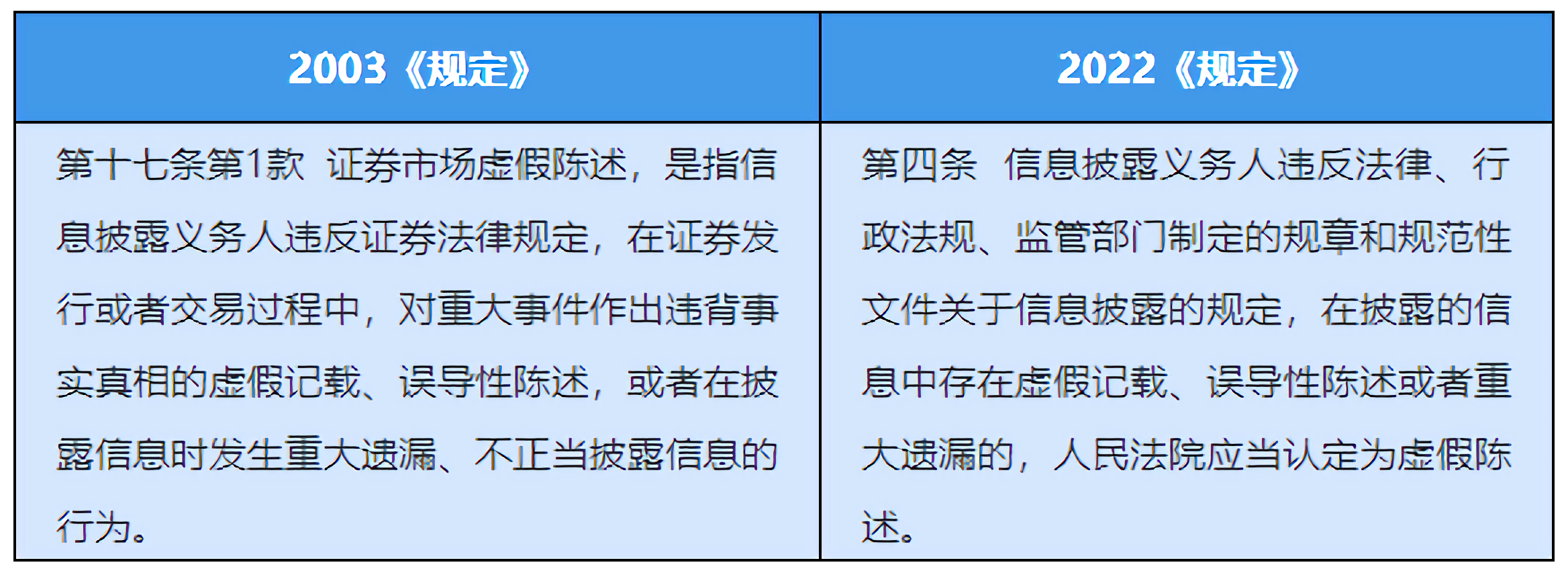

4. The concept of "four days, one price, three acts" has been clarified and improved.

In the case of misrepresentation in the securities market, the core concept is "four days, one price, three acts".

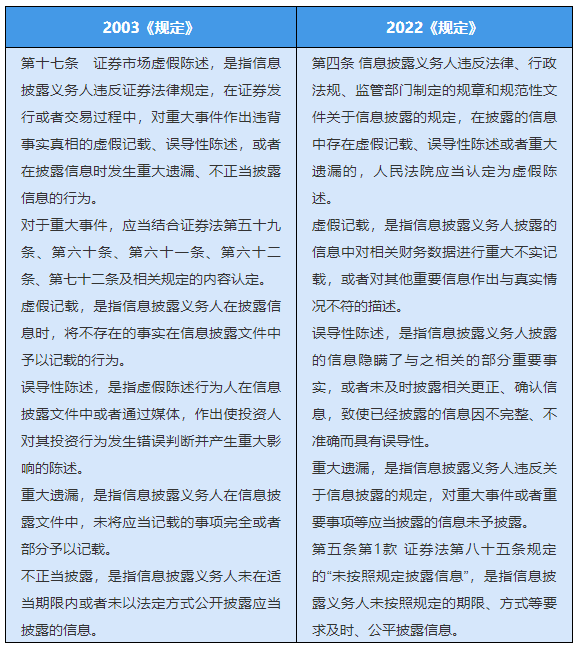

1."Three acts" refers to the existence of false records, misleading statements or material omissions in the information disclosed by the information disclosure obligor, and the existence of any of the acts is a false statement.

Compared with the definition of the three behavior concepts in the 2003 Regulations, the 2022 Regulations have made scientific and reasonable adjustments, making the connotation of the three behavior concepts richer and more complete, the generalization power is significantly improved, and the extension of the concept has also been appropriately expanded, expanding the scope of the identification of false statements.

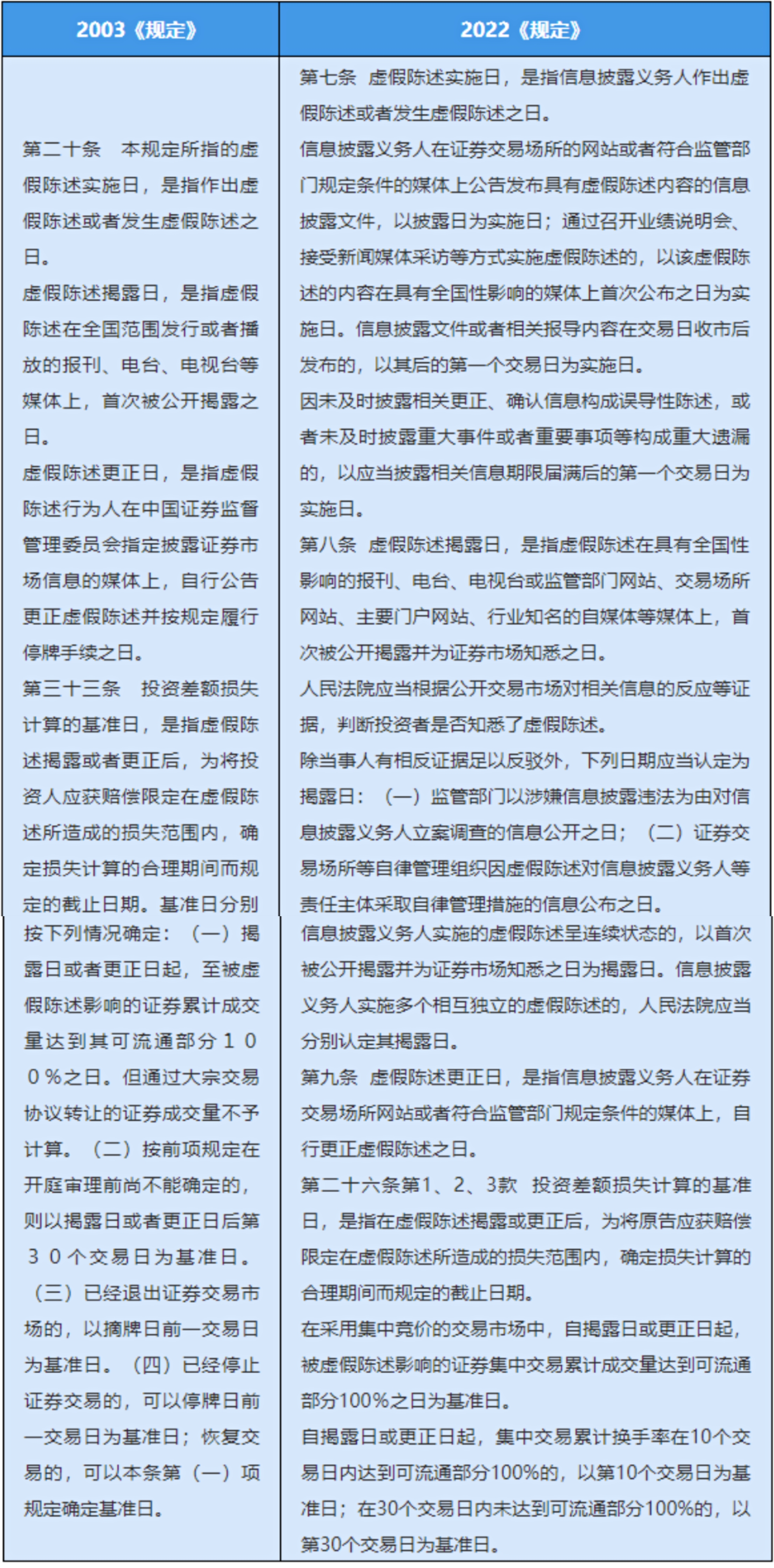

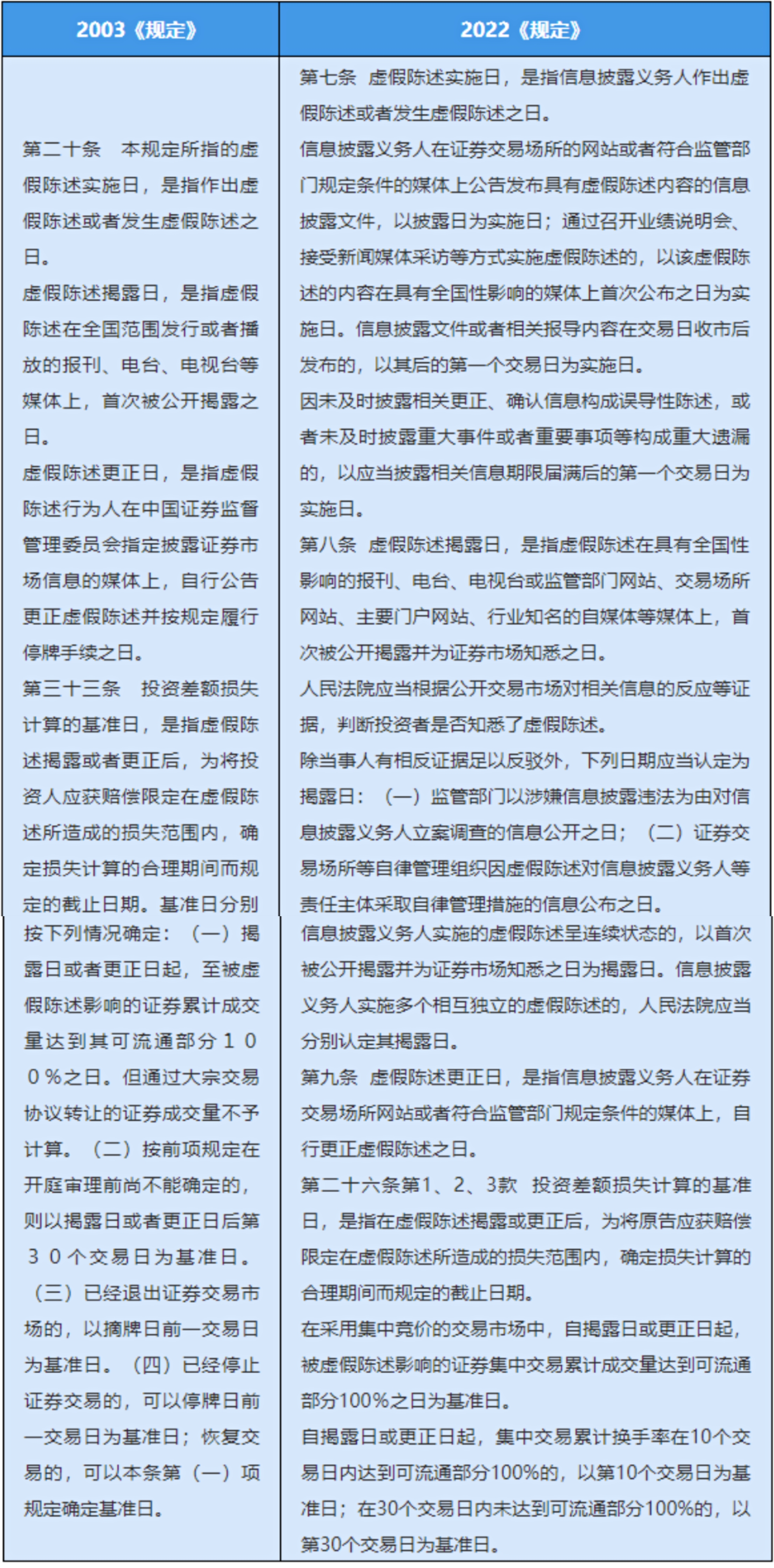

2."Four days" means the implementation date of the misrepresentation, the disclosure date, the correction date and the base date for the calculation of the loss.

With regard to the implementation date, disclosure date and correction date of false statements, comparing the two versions of the Provisions, it can be seen that the concept of the aforementioned "three days" has not changed much, but the 2022 Provisions have increased the identification method of the two days under different circumstances by listing on the implementation date and disclosure date. In practice, the original defendant's claim on the date of implementation and disclosure of false statements is usually controversial, and in order to unify the criteria for identification, the 2022 Provisions have made highly operational provisions on this.

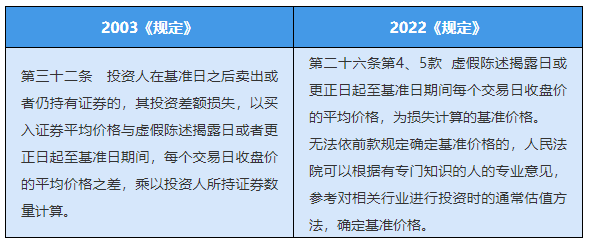

The concept of the base date for the calculation of losses remains essentially unchanged, but the manner in which the base date is recognized has changed. First, it remains unchanged that, from the date of disclosure or correction, the date on which the cumulative volume of centralized trading of securities affected by misrepresentation reaches 100 per cent of the negotiable portion is the base date, and the volume of securities transferred through block trading agreements is still excluded when counting the cumulative volume. Secondly, what has changed is that the confirmation of the base date is more predictable, 2022 under the Regulations, the base date is either the 10th trading day from the date of disclosure or correction, or the 30th trading day from the date of disclosure or correction.

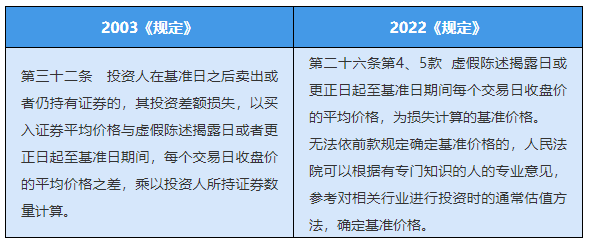

3. "One Price" means the base price. 2003 there is a statement about the base price in the Regulations, but it is not clearly defined, 2022 the Regulations make this clear, which is conducive to uniform application, and for the determination of the base price in special circumstances, it also provides for a method.

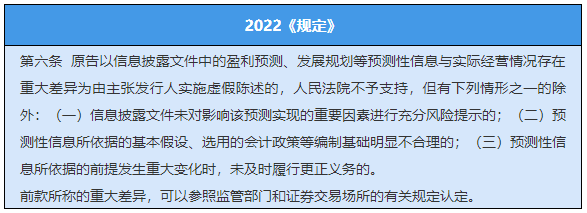

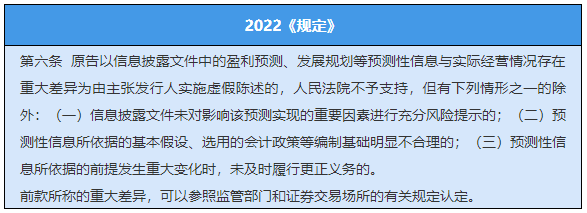

5. Adds "predictive information safe harbor" system

In order to encourage issuers to voluntarily disclose predictive information such as profit forecasts and development plans, improve the quality of information disclosure, and enrich the content of information disclosure, and because the disclosure standards of predictive information and established information are relatively different, overseas securities laws and regulations generally formulate "Safe Harbor System" to limit the civil liability for misrepresentation of predictive information disclosed by issuers. In light of the actual situation of China's securities market, the 2022 Regulations have adopted the practice of the system, but in order to prevent the system from being abused by issuers and improperly harming the interests of investors, the system has also been restricted.

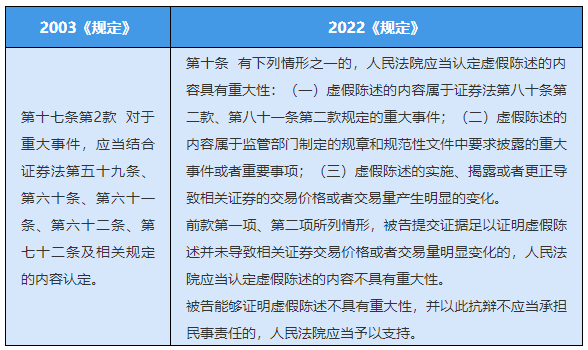

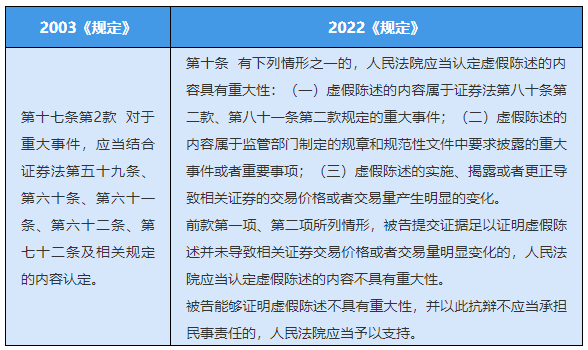

6. Improve the "Major" Identification Standard

In the dispute of false statement, whether the false statement of the information disclosure obligor constitutes "material nature" is the focus of the debate. According to the 2003 "Regulations", the plaintiff must convince the court that the defendant's false statement is "material" before its loss claim can be supported; and if the defendant can convince the court that the defendant's false statement is not "material", even if the defendant The false statement has received administrative penalties, and it may not be liable for compensation for investor losses. For such an important issue, the 2022 "Regulations" have been perfected and refined on the basis of the original clauses, unifying and clarifying the identification standards of "significance.

7. Binary "causality", transaction causality and loss causality go hand in hand

According to the relevant provisions of the 2003 Regulations, the elements of tort liability for misrepresentation are that the disclosure obligor has committed the misrepresentation, the investor's investment has been damaged, and there is a causal relationship between the misrepresentation and the result of the damage, and there is no requirement to examine whether the misrepresentation is related to the investor's investment decision. The relevant provision does not strictly follow the analytical logic of the elements of tort liability, making it subject to such questions as "misrepresentation liability reduced to investment loss insurance" in practice. In addition, should investors who suffer investment losses only as a result of stock price movements due to misrepresentation receive the same loss-filling protection as investors who rely directly on misrepresentation to make investment decisions? The different rules on the allocation of the burden of proof and the rules on adjudication held by different adjudicators have also sparked controversy. In this regard, the 2022 of the provisions of the response.

The 2022 Regulations clearly distinguish causality as "transaction causality" and "loss causality". From the specific content point of view, the 2022 "Regulations" will 2003 the content of causality in the "Regulations" after being revised as the content of "transaction causality", and a new "loss causality" determination clause will be added. Accordingly, the elements of tort liability for misrepresentation are adjusted to the fact that the disclosure obligor has committed a misrepresentation, the investor makes an investment decision directly based on the aforementioned misrepresentation, the investor suffers a loss from the investment, and there is a causal relationship between the misrepresentation and the investor's loss.

2022 the arrangement of the dictation of causation in the Provisions, the rule of proof of causation is reconstructed, which is a restriction on the principle of "presumption of trust", clearly defines the corresponding burden of proof for the plaintiff, balances the protection of the interests of investors and issuers to a certain extent, and highlights the principle of fair and just revision. However, it is worth noting that in the case of false statement, it is objectively difficult for investors to prove the establishment of "transaction causality". Too difficult to prove may make the burden of proof directly mean losing the lawsuit. Therefore, how to appropriately allocate the burden of proof and how to determine that the burden of proof cannot be proved in practice will inevitably pose a test and challenge to the referee.

8. In-depth refinement of the fault and responsibility of different subjects of the standard.

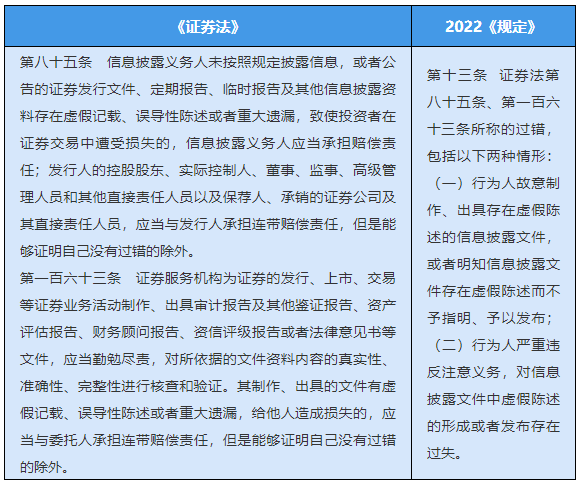

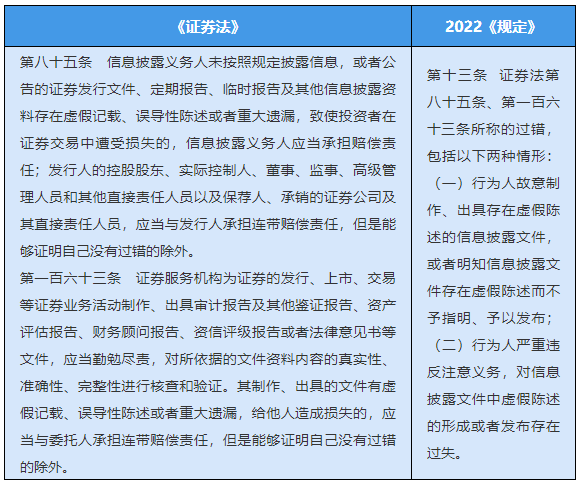

1. A general definition of what is "fault"

2022 "Regulations" highly refine the faults mentioned in Article 85 and Article 163 of the Securities Law.

2. Refine the fault and liability determination criteria of the issuer's directors, supervisors and directly responsible personnel.

From the specific content point of view, 2022 "provisions" fully summarize and absorb the practice of the original defendant between the appeal and defense experience, so that this part of the provisions of both reality and practicality, presumably will make the agent who has undertaken the case of misrepresentation to read a sense of deja vu.

However, what is worrying is that the 2022 "Regulations" have changed the statement in the 2003 "Regulations" that "the issuer, the responsible directors, supervisors, and managers of the listed company shall be jointly and severally liable for the losses in the preceding paragraph". It is not clear whether the issuer's directors, supervisors, and directly responsible persons shall bear joint and several liability for the plaintiff's losses. Although the words "joint and several liability" and "joint and several responsible persons" are left in Article 23, paragraph 1, and Article 32, paragraph 2 of the provisions of the 2022, in view of the provisions of Article 178 of the Civil Code, paragraph 3 stipulates that "joint and several liability shall be stipulated by law or agreed by the parties", what kind of compensation liability shall be borne by the directors, supervisors and personnel directly responsible for the plaintiff's losses may cause disputes.

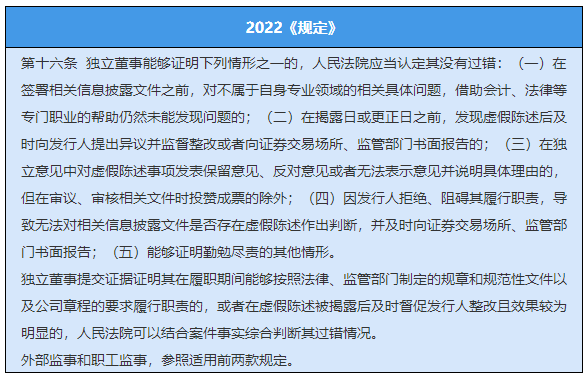

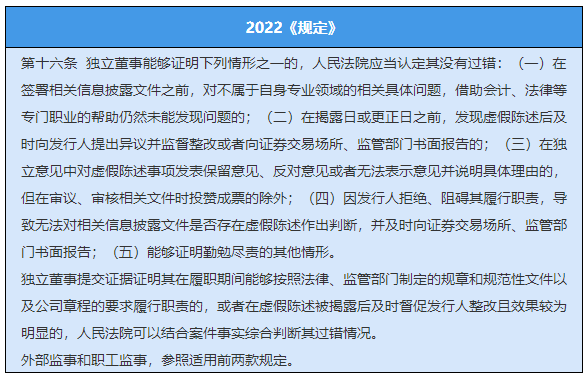

3.Clarify the reasons for the exemption of independent directors.

On November 12, 2021, the "Kangmei case" was pronounced by the Guangzhou Intermediate People's Court in the first instance, which directly led to the resignation of many independent directors of listed companies, which had a huge impact on the governance of the securities market and the independent director system, and also triggered market investors' operational anxiety about the listed companies concerned. The 2022 "Regulations" clarify the reasons for the exemption of independent directors. It is a response to the concerns of all walks of life caused by the "Kangmei" case. It emphasizes the protection of the "independence" and "externality" of independent directors, and encourages independent directors to be diligent and responsible. The 2022 "Regulations" At the same time, it is clear that external supervisors and employee supervisors can refer to the application of independent directors' exemption defenses.

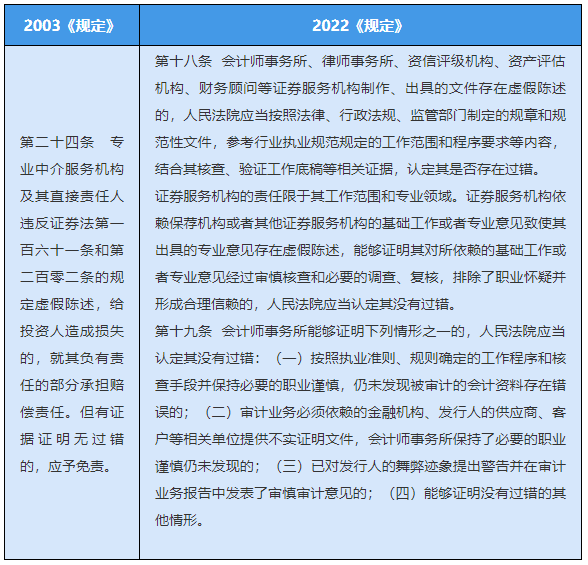

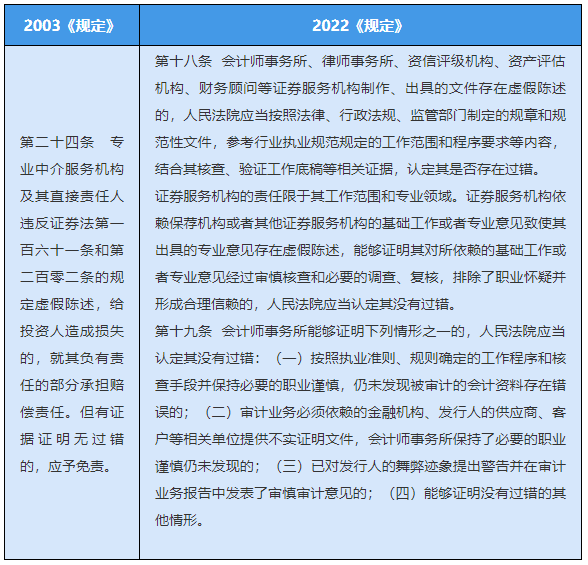

4. Breakdown of fault and liability criteria for sponsors, underwriters and securities service providers

On December 31, 2020, the Hangzhou Intermediate People's Court made a first-instance judgment on the country's first case of fraudulent issuance of corporate bonds-the "Wuyang case"-and ordered the lead underwriters, accounting firms, rating companies, law firms and other intermediaries to bear joint or proportional joint and several liability. The Hangzhou Intermediate People's Court pointed out that letting the saboteurs pay the price of destruction and making the "gatekeepers" who pretend to sleep dare not pretend to sleep is the basic attitude of judicial trials towards false statements in the securities market. This judgment is like a stone stirring up a thousand waves, which has aroused widespread concern and heated discussion on the responsibility boundary of the "gatekeeper" in the securities market.

As for the fault and liability determination of sponsor institutions, underwriting institutions and securities service institutions, the original relevant provisions of the 2003 Provisions are more principled, general and lack of operability. The 2022 Provisions subdivide and improve this, which is obviously a response to the concerns caused by the "Wuyang case.

(1)Clarify the criteria for determining the fault of the sponsor and the underwriting institution, affirm the reasonable trust of the sponsor and the underwriting institution in the professional opinion of the securities service institution, and prohibit the sponsor and the underwriting institution from recovering the losses it has incurred as a result of the false statement from the issuer, the controlling shareholder and the actual controller in an agreed manner.

(2)Clarify the criteria for determining the fault and liability of securities service providers, affirm the reasonable trust of securities service providers in the basic work or professional opinions of sponsors and other securities service providers, and particularly clarify the defense of the accounting firm's exemption from liability.

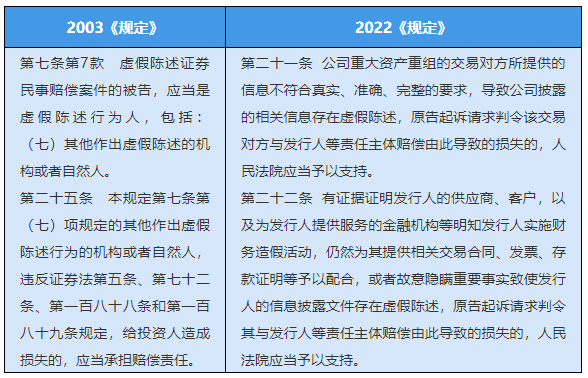

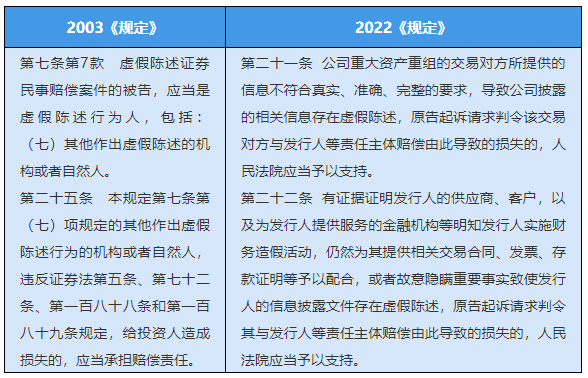

5.Clarify the liability of reorganizing counterparties and helping counterfeiters

If the counterparty to the material asset reorganization causes the issuer to disclose false statements in the information disclosed by the issuer, and if the issuer's suppliers and customers intentionally help the issuer to carry out fraudulent activities, they shall be directly liable to the plaintiff as defendants.

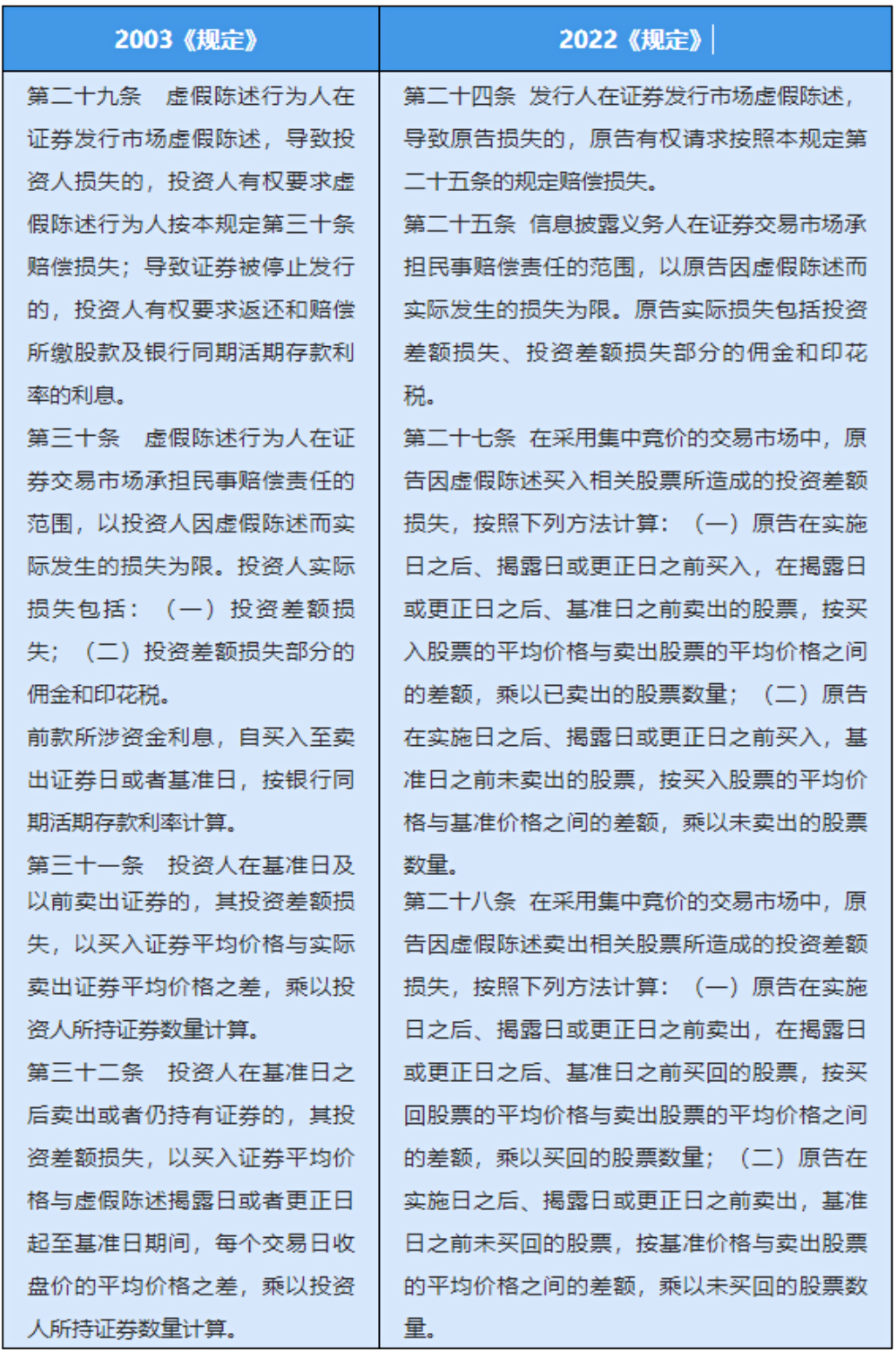

9. Adjustment of the scope of compensation for investors' losses

Mainly reflected in two aspects. First, the 2022 "Regulations" adjusted the actual loss of investors to the loss of investment difference, the commission and stamp duty of the loss of investment difference, compared with the 2003 "Regulations", deleted "the interest on the funds involved in the preceding paragraph, from the date of purchase to the sale of securities or the base date, according to the bank's demand deposit interest rate for the same period" and other content.

Second, the lure-type misrepresentation is included in the scope of the claim. It has been proved in practice that the inducement of false statements can also lead to losses for investors, and the 2022 Provisions, on the basis of the inducement of multiple false statements established in the 2003 Provisions, include the inducement of false statements into the scope of regulatory adjustment, further improve the compensation system for false statements, and effectively protect the interests of investors. According to the 2022 Regulations, if the discloser has committed a misrepresentation and the investor sells the related shares after the implementation date, the disclosure date or the correction date, it is presumed that the investor's investment decision establishes a causal relationship with the lure-type misrepresentation; the method of calculating the loss of the lure-type misrepresentation remains unchanged, the loss calculation method of short-selling misrepresentation is divided into two situations:(1) for the stocks bought back by investors during the period from the disclosure date or the correction date to the base date, the calculation method is "investment difference loss = (the average price of buying back-the average price of selling back) x the number of shares bought back";(2) for the stocks that investors did not buy back before the base date, it is calculated as "investment margin loss = (base price-average selling price) x number of shares not bought back".

It is worth mentioning that article 20, paragraph 2, of the 2022 Regulations clarifies that the issuer, after assuming liability, has the right to demand compensation from the controlling shareholder and actual controller who organized and instructed the issuer to make false statements, for losses such as compensation actually paid, reasonable attorney's fees and litigation costs, combined with the provisions of Article 25 of the provisions of the Supreme people's Court on several issues of Securities dispute Representative Litigation, "if the (ordinary) representative requests the losing defendant to compensate for reasonable announcement fees, notice fees, attorney fees and other expenses, the people's court shall support it." it can be considered that in the case of false statement, the reasonable attorney fees paid by the plaintiff under certain conditions can be claimed by the defendant.

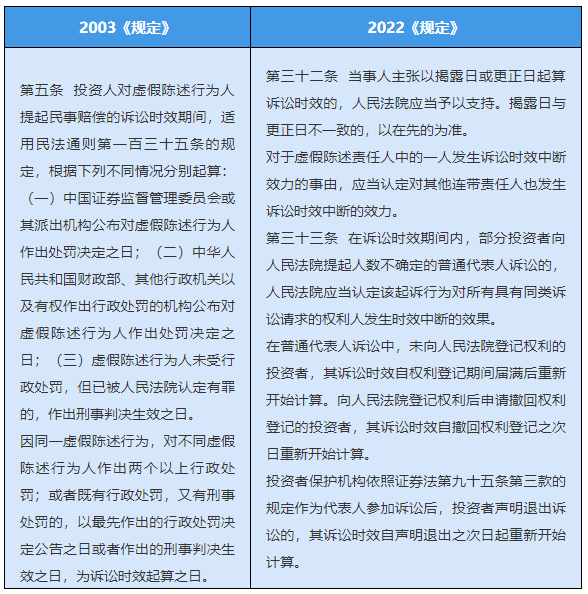

10. a unified statute of limitations calculation node, clear the validity of the statute of limitations interruption and special circumstances.

2003 the "Regulations" due to the existence of pre-litigation procedures, resulting in false statement cases of the starting point of the statute of limitations need to distinguish between different situations, 2022 the "Regulations" to cancel the pre-litigation procedures, clear the statute of limitations from the starting point to the disclosure date or correction date is the meaning of the question. Considering that there are often co-defendants in misrepresentation cases and the special circumstances in ordinary representative litigation, the 2022 Provisions also clarify the effect and circumstances of the interruption of the statute of limitations.

2022 "Regulations" fully reflect the Supreme People's Court's spirit of advancing with the times and moderately forward-looking judicial interpretation revision. The writing is concise and comprehensive, with high coverage, novel and detailed content, and strong operability. It is quite good for judicial judges and practicing lawyers. friendly. In the nearly two decades since the implementation of the 2002 "Notice" and the 2003 "Regulations", in the more than one year of "comprehensive implementation and step-by-step implementation of the securities issuance registration system", China's capital market has undergone and will continue to undergo major changes. In this context, 2022 the revision, issuance and implementation of the "Regulations", "the sword refers to the stubborn disease of financial fraud in the capital market, increasing the illegal costs of illegal actors in accordance with the law" and "protecting the legitimate rights and interests of investors" will surely promote the healthy development of the capital market.

Introduction to the Author

![]() Loading...

Loading...![]() 2022.01.24

2022.01.24