Income tax has always been a key consideration in corporate restructuring. On April 30, 2009, the Ministry of Finance and the State Administration of Taxation jointly issued the Notice on Several Issues Concerning the Treatment of Enterprise Income Tax on Enterprise Restructuring (Caishui (2009) No. 59), which is the first time in the field of tax law to define enterprise restructuring, and the so-called enterprise restructuring refers to the transaction in which the legal structure or economic structure of an enterprise changes significantly outside its daily business activities, including changes in the legal form of the enterprise, debt restructuring, equity acquisition, asset acquisition, merger, separation and so on. Document No. 59 also clarifies the rules for the tax treatment of corporate and corporate shareholders' income tax. However, in the practice of corporate restructuring, the issue of personal tax obligations of natural person shareholders is often not paid attention to and clarified. Based on the two reorganization methods of enterprise merger and separation, this paper discusses whether the natural person shareholders of the merged and separated enterprises should pay personal income tax.

Income tax has always been a key consideration in corporate restructuring. On April 30, 2009, the Ministry of Finance and the State Administration of Taxation jointly issued the Notice on Several Issues Concerning the Treatment of Enterprise Income Tax on Enterprise Restructuring (Caishui (2009) No. 59), which is the first time in the field of tax law to define enterprise restructuring, and the so-called enterprise restructuring refers to the transaction in which the legal structure or economic structure of an enterprise changes significantly outside its daily business activities, including changes in the legal form of the enterprise, debt restructuring, equity acquisition, asset acquisition, merger, separation and so on. Document No. 59 also clarifies the rules for the tax treatment of corporate and corporate shareholders' income tax. However, in the practice of corporate restructuring, the issue of personal tax obligations of natural person shareholders is often not paid attention to and clarified. Based on the two reorganization methods of enterprise merger and separation, this paper discusses whether the natural person shareholders of the merged and separated enterprises should pay personal income tax.

The content of this article

1. Main tax laws and policies

2. Sorting out the official consultation reply of the Inland Revenue Department

3. This article views sharing

4. Thoughts and Suggestions

1. Main tax laws and policies

The merger/separation of enterprises mainly involves the income tax treatment of two subjects: one is whether the losses of the merged/separated enterprise can be carried forward in the merged/separated enterprise; the other is how the shareholders of the merged/separated enterprise should pay income tax. Shareholders can be either legal persons or natural persons, but there is an imbalance in the current income tax policy between the two types of shareholders.

1. Corporate income tax field

Tax (2009) No. 59 has two provisions on the income tax treatment of corporate shareholders: general tax treatment and special tax treatment.

In a business combination/separation, there is usually a change in equity ownership. Generally, tax laws require recognition of gains or losses from equity changes, and shareholders are subject to income tax on the benefits of equity mergers/demerger, which is the logic of general tax treatment. However, there are also some enterprises that have not changed their mode of operation and content before and after the merger/separation, and the transaction process does not involve or rarely involves monetary payment. Therefore, the purpose of such corporate restructuring is not to transfer assets for profit, but to optimize the allocation of resources, strengthen the competitiveness of enterprises in the market, shareholders' rights and interests have not changed substantially. If shareholders are taxed, it will increase transaction costs, be detrimental to the competitive development of a market economy and violate the principle of tax neutrality. Therefore, No. 59 provides that such enterprises may choose special tax treatment: that is, to meet certain applicable conditions of restructuring transactions, the corporate shareholders of the equity payment portion of the current recognition of disposal gains and losses, until the future corporate shareholders will transfer the equity to confirm the taxable income.

On July 26, 2010, the State Administration of Taxation issued the announcement of the measures for the Administration of Enterprise income tax on Enterprise restructuring Business (State Administration of Taxation announcement No. 4 of 2010) further stipulates that all parties involved in the same restructuring business shall adopt the principle of consistent tax treatment, that is, unified tax treatment according to general or special.

2. Personal income tax field

As to whether the natural person shareholders involved in the merger/division of enterprises can and how to distinguish the application of general tax treatment or special tax treatment, the tax law and tax policy have no clear provisions at present, It is only mentioned in the announcement on Several Issues concerning the collection and administration of enterprise income tax for enterprise restructuring business (State Administration of Taxation Announcement No. 48 of 2015) issued by the State Administration of Taxation in June 2015. The announcement clearly states: "In a restructuring transaction, the transferor in the equity acquisition, the shareholders of the merged enterprise in the merger and the shareholders of the divided enterprise in the merger may be natural persons. Natural persons among the parties shall be taxed in accordance with the relevant provisions of individual income tax."

2. Inland Revenue Official Consultation Reply Summarized

We found a total of 13 answers to related questions through the online message module of the State Administration of Taxation 12366 Tax Service Platform. The views of local tax bureaus can be classified into the following two categories:

1. In the merger/division of enterprises, if individual shareholders are involved in the transfer of equity or investment in non-monetary assets, they shall pay personal income tax according to the item "income from property transfer"; if it involves the distribution of retained profits, they shall pay personal income tax according to the item "income from interest, dividends and dividends.

2, reference to non-monetary assets to assess the value-added treatment, that is, mainly to see whether the separation of the enterprise's paid-in capital changes, if the increase in paid-in capital on behalf of non-monetary assets value-added, need to pay personal income tax. Whether it is a split or a merger, if the original value of the individual's original equity is less than the original value of the new enterprise's equity, there is an increase in value and personal income tax is required.

3. This article views sharing

From the results of the above responses, the settlement standards of the tax authorities are not consistent. Even in accordance with the requirements of the tax authorities, how to determine whether natural person shareholders involved in equity transfer and other acts, still face the difficulty of unified interpretation. Not only that, there is a view in current practice: No. 48 is a document that regulates corporate income tax, so it cannot be applied to natural person shareholders. For changes in the ownership and equity of shareholders involved in the merger/division of a natural person shareholder, the gain or loss on the disposal of assets shall be recognized at fair value and personal income tax shall be paid. We believe that this view is inevitably biased, and the determination of whether a natural person shareholder is required to pay a tax should be returned to the provisions of the Personal Income Tax Law, I .e., based on the determination of whether the equity held by a natural person shareholder has increased in value or whether an equity transfer has occurred. The following examples are discussed:

Scenario 1: After the merger/separation of the enterprise, the proportion of shares held by natural person shareholders remains unchanged, and the cost of holding investment (tax basis) remains unchanged.

例1-1:Company A's paid-in capital is 1 million yuan, and natural person shareholder A's paid-in 600000 yuan holds 60% of the equity. A company is divided into A1, A2 two companies. The paid-in capital of Company A1 is 300000 yuan, and the paid-in capital of Company A2 is 700000 yuan. A1 and A2 inherit assets and liabilities in proportion and do not exceed the business scope of Company A. A continues to hold 60% equity of Company A1 and A2 respectively.

分析:From an economic point of view, Company A is divided into two companies. For shareholder A, it is equivalent to dividing the equity rights and interests controlled by Party A. However, the investment cost (tax basis) of the equity held by Party A has not changed-after the division, the shareholder is still Party A, the shareholding ratio is still 60%, and the shareholding cost (tax basis) is still 600000 yuan. Therefore, we believe that before and after the division/merger of the enterprise, under the condition that the shareholding ratio of shareholders remains unchanged and the investment cost of shareholding remains unchanged, natural person shareholders are not involved in personal tax obligations. However, the amount of non-equity payment obtained by means of monetary funds and exceeding the investment cost (tax basis) of the equity held shall be regarded as profit distribution, and natural persons shall pay personal tax according to the items of "interest, dividend and bonus income.

If the separated enterprise does not divide the assets and liabilities according to the proportion, does the natural person shareholder have the tax obligation? The analysis is as follows:

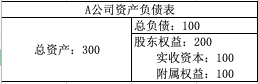

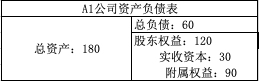

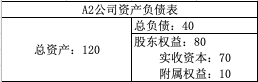

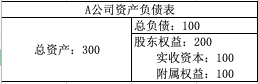

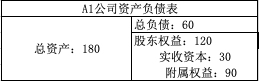

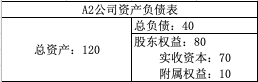

Example 1-2:In the same example 1-1, before the division, Company A has total assets of 3 million yuan, total liabilities of 1 million yuan, and total shareholders' equity of 2 million yuan: of which paid-in capital of 1 million yuan, capital reserve and surplus reserve of 1 million yuan (hereinafter referred to as "subsidiary equity"). Company A has a 3:7 split equity investment cost (tax basis), I .e. the paid-in capital of Company A1 is 300000 yuan and the paid-in capital of Company A2 is 700000 yuan, but A1 and A2 inherit the assets and liabilities of Company A according to a ratio of 6:4, and Company A holds 60% equity of A1 and A2 respectively after split:

分析:Although the subsidiary rights and interests of shareholders of the separated enterprise are not distributed according to the ratio of 3:7 due to the unbalanced distribution of assets and liabilities, in economic essence, the investment cost (tax basis) of the separated company's equity held by A is still 600000 yuan, the corresponding amount of shareholders' equity is still 1.2 million yuan, and the shareholders' equity has not changed. We believe that the analysis in Example 1-1 is still consistent with the conclusion that the natural person shareholder is not involved in a tax liability. However, if we look in depth, the inconsistency between the paid-in capital split ratio and the asset-liability split ratio in the process of enterprise separation actually involves the issue of changes in the risk of repayment of the company's creditors, which will not be discussed in depth here.

Scenario 2: After the merger/separation of the enterprise, the proportion of shares held by natural person shareholders changes, and the cost of holding the investment remains unchanged.

例2:Company A's paid-in capital is 1 million yuan, natural person shareholder A pays-in 600000 yuan to hold 60% of the equity, and B holds 40% of the equity and pays-in 400000 yuan. Company A is divided into Company A1 and Company A2. Company A1 has paid-in capital of 300000 yuan and Company A2 has paid-in capital of 700000 yuan. Company A1 and A2 have not changed the business essence of Company A. Company A holds 70% equity of Company A1 and Company A2.

分析:Regarding the original 60% equity part held by A, the same example 1 is dealt with. Regarding the newly acquired 10% equity part of A, since the paid-in capital has not changed, the situation of capital increase and share expansion can be excluded, so it is essentially A's transfer of 10% equity from B. B the transfer of 10% of the equity, in accordance with the State Administration of Taxation Announcement No. 67 of 2014 to determine whether the need to declare and pay tax; A newly acquired 10% equity, according to its payment consideration method (whether the consideration, what kind of consideration) to judge whether the need to declare and pay tax.

Scenario 3: After the merger/separation of the enterprise, the shareholding ratio of natural person shareholders remains unchanged and the total amount of paid-in capital changes.

Example 3:Company A's paid-in capital is 1 million yuan, natural person shareholder A pays-in 600000 yuan to hold 60% of the equity, and B holds 40% of the equity and pays-in 400000 yuan. Company A is divided into Company A1 and Company A2. Company A1 has paid-in capital of 1 million yuan and Company A2 has paid-in capital of 1 million yuan. Company A1 and A2 have not changed the business essence of Company A. Company A holds 60% equity of Company A1 and Company A2.

Analysis:It needs to be discussed according to different situations:(1) If the increase of investment cost of A's shareholding is cash addition, personal income tax is not required at the investment stage;(2) If the increase of paid-in capital is caused by capital reserve or surplus reserve to increase capital: ① In the case of capital premium to increase, we think A does not need to pay personal income tax (although local tax bureaus have different implementation standards);② Increase paid-in capital by other capital reserve or surplus reserve, we believe that the economic essence should be broken down into two transactions: dividends to shareholders and capital increase by shareholders with dividends.

Scenario 4: After the merger/separation of the enterprise, the shareholding ratio of natural person shareholders changes and the total amount of paid-in capital changes.

Example 4:In the same example 3, after the separation, the paid-in capital of A1 company is 1 million yuan, and the paid-in capital of A2 company is 1 million yuan. A1 and A2 have not changed the business essence of company a, and the proportion of shares held by company a in A1 and A2 companies has changed to 40% respectively.

Analysis:There are two reasons for the decline in A's shareholding:(1) the transfer of 20% of A's equity to B; and (2) the decline in A's shareholding due to B's capital increase. For equity transfer, the provisions of the State Administration of Taxation Announcement No. 67 of 2014 shall be applied to the judgment, which will not be repeated here. Regarding the individual tax involved in the capital increase and share expansion of B, we have written an article to discuss the individual tax issue, see."The article "Discussion on whether individual shareholders need to pay personal income tax on capital increase and share expansion --- Taking the consultation reply of Guangdong Zhanjiang Tax Bureau as an example.

In particular, the above example to the separation of enterprises to explore, on the merger of enterprises involved in the natural person shareholders tax issues, with reference to the separation of the shareholding ratio, shareholding costs (tax basis) of the change and unchanged to analyze and judge, this article will not repeat.

Looking at the content of No. 59, its core is to determine what conditions can be reached to determine that the reorganization transaction has the essence of optimizing the allocation of resources, so that corporate shareholders can apply special tax treatment. So the core of the problem is that the enterprise income tax law does not give law enforcement agencies the power to tax the optimal allocation of resource-based restructuring transactions. Therefore, No. 59 is not to solve the problem of whether corporate shareholders should pay taxes, but to solve how to determine whether it belongs to the optimal allocation of resource-based restructuring transactions.

Similarly, even if there is no similar standard in the personal income tax law, it does not mean that natural person shareholders must pay a tax. Combined with the above case analysis results, we believe that the judgment standard of personal income tax in practice should not be lower than that of enterprise income tax, otherwise it will appear in the same enterprise. Legal person shareholders do not need to pay enterprise tax, but natural person shareholders need to pay individual income tax. There are completely different income tax treatments for the same economic business, which actually violates the principle of tax fairness.

In summary, we suggest that the tax authorities should comprehensively and carefully consider the consistency of the tax obligations of corporate shareholders and natural person shareholders at the income tax level, and issue relevant regulations as soon as possible to regulate the law enforcement standards in such cases. At the same time, we recommend that enterprises do a good job in the overall planning and design of the transaction model and tax-related parts of the transaction documents before the merger/separation, in order to safeguard the rights of taxpayers and reduce subsequent tax risks in accordance with the law.

![]() Loading...

Loading...![]() 2023.04.21

2023.04.21