Shengdian Dynamic | "More than fast" online, to help financial institutions quickly resolve bad risks.

![]() Loading...

Loading...

![]() 2024.04.09

2024.04.09

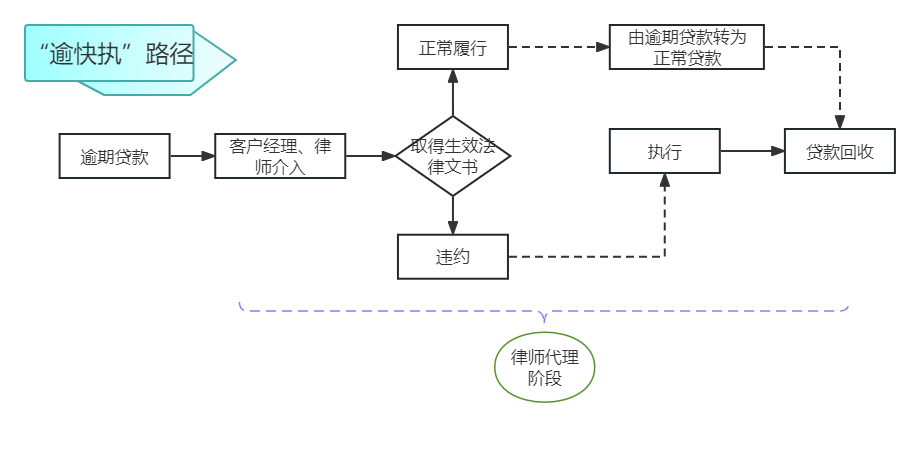

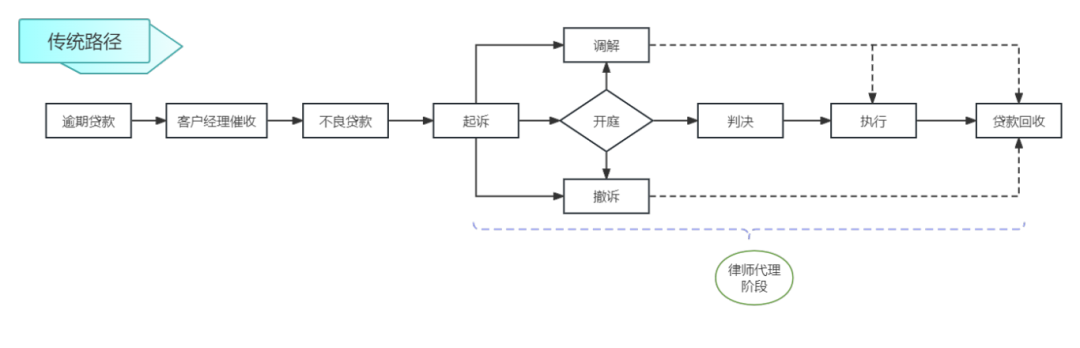

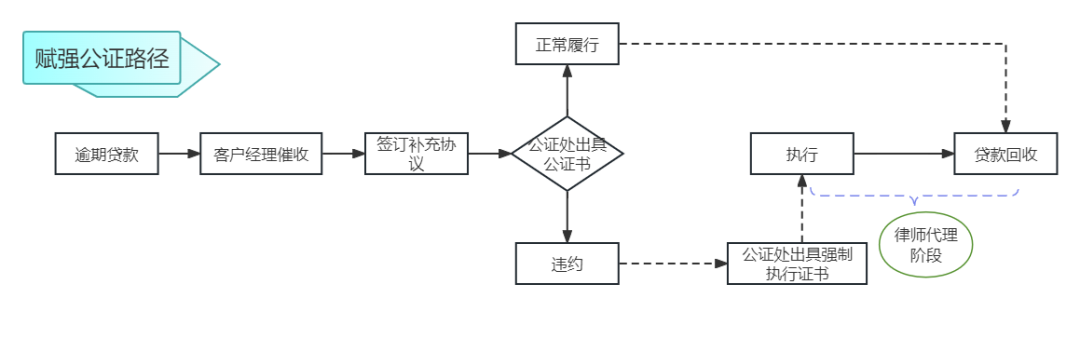

This product is mainly aimed at personal mortgage loans, personal business loans and corporate mortgage projects with overdue or other risk signals in the early stage, and can be applied to all loan projects that the bank deems necessary in the later stage.

Take, for example, the treatment of financial claims with a subject matter of $10 million:

| Traditional Litigation | Fu Qiang notarization | "More than fast" products | |

| Time |

6-10 months

The ordinary procedure of the first instance is 6 months + the appeal period of the second instance (such as appeal) is 15 days, the defense period is 15 days, and the second instance period is 3 months (even if the parties do not raise objection to jurisdiction, it takes 10 months for the whole process to be seamlessly connected) |

1 month

The notary office shall issue an enforcement certificate after reviewing the borrower's default. |

7-30 days

The mediation is usually completed 7-30 days after the acceptance of the mediation case, and the judicial confirmation ruling and mediation letter are obtained. |

|

Cost |

1.The first instance acceptance fee is 81800 yuan; (Common Procedure Standard, Mediation Halved) 2.The acceptance fee for the second instance is 81800 yuan (charged for the amount of the subject matter of the appeal dispute); 3.If the attorney's fees are actually paid, they can be claimed together in the prosecution. |

1.A notary fee of $25000 is charged at 0.25 per cent of the total debt; 2.Follow-up need to hire a lawyer to apply for compulsory, the lawyer's fee is charged separately; 3.Lawyer fees cannot be passed on. |

1.Judicial confirmation does not charge a case acceptance fee; 2.The attorney's fees are generally borne by the breaching party in accordance with the credit contract. |

|

Lawyer Service Phase |

From the beginning of the prosecution to the end of the execution, completion. |

Application for enforcement to the end of the execution, completion. |

From the date the loan is overdue to the entire loan recovery. |

|

风险 |

1. Involving first instance, second instance and retrial procedures, the litigation cycle may be long; 2. The period may involve a variety of uncertainties such as the debtor's insolvency; 3. Judgment results can be difficult to predict. |

1. The party concerned may revoke the compulsory execution certificate issued by the notary office by applying for an execution objection; 2. Uncertainties such as the insolvency of the debtor may be involved during the execution objection period; 3. If the execution objection is successful, the case needs to be filed, litigated and executed, and the recovery cycle is lengthened. |

1. Legal documents with enforcement force can be obtained in the shortest possible time; 2. The result of mediation is reached voluntarily by the parties. After the court reviews the legality, voluntariness and enforceability of the mediation agreement, it can directly enter the execution procedure according to Article 202 of the Civil Procedure Law. |

|

Subject amount |

Rate |

|

No more than 10000 yuan |

Each charge 50 yuan |

|

The part exceeding 10000 yuan to 100000 yuan |

1.25% |

|

The part exceeding 100000 yuan to 200000 yuan |

1% |

|

The part exceeding 200000 yuan to 500000 yuan |

0.75% |

|

The part exceeding 500000 yuan to 1 million yuan |

0.5% |

|

The part exceeding 1 million yuan to 2 million yuan |

0.45% |

|

The part exceeding 2 million yuan to 5 million yuan |

0.4% |

|

The part exceeding 5 million yuan to 10 million yuan |

0.35% |

|

The part exceeding 10 million yuan to 20 million yuan |

0.3% |

|

The part exceeding 20 million yuan |

0.25% |

Contact Phone:

Lawyer Yu-yi:15813869159

Email address:

yuyi@shengdian.com.cn

Contact Address:

Floor 17 and 25, Block A, International Innovation Center, 1006 Shennan Avenue, Futian District, Shenzhen

Sweep the above two-dimensional code and add friends.

For more than ten years, Yu yi lawyers have carefully built a financial services team.