Shengdian Dynamic | Lawyer Han Ming was invited to give a special lecture on "Handling of Difficult Economic Crime Cases-Taking False Tax Fraud and Smuggling Cases as an Example" in Shenzhen Lawyers Association.

![]() Loading...

Loading...

![]() 2024.04.19

2024.04.19

On the afternoon of April 18, under the guidance of the Judicial Bureau of Futian District, Shenzhen City, the Professional Training Working Committee of Shenzhen Lawyers Association and the Futian District Lawyers Working Committee of Shenzhen Lawyers Association jointly organized the professional lecture "Handling of Difficult Economic Crime Cases-False Tax Fraud and Smuggling Cases as Examples" was successfully held in the Multi-function Hall of Shenzhen Lawyers Association. The speaker of this lecture is lawyer Han Ming, director of Shengdian Criminal Defense Law Professional Committee.

The response to the lecture was enthusiastic, and the online live broadcast was watched by more than 7600 people. Lawyers from Han brought a rich, professional and meticulous sharing to the online and offline participants.

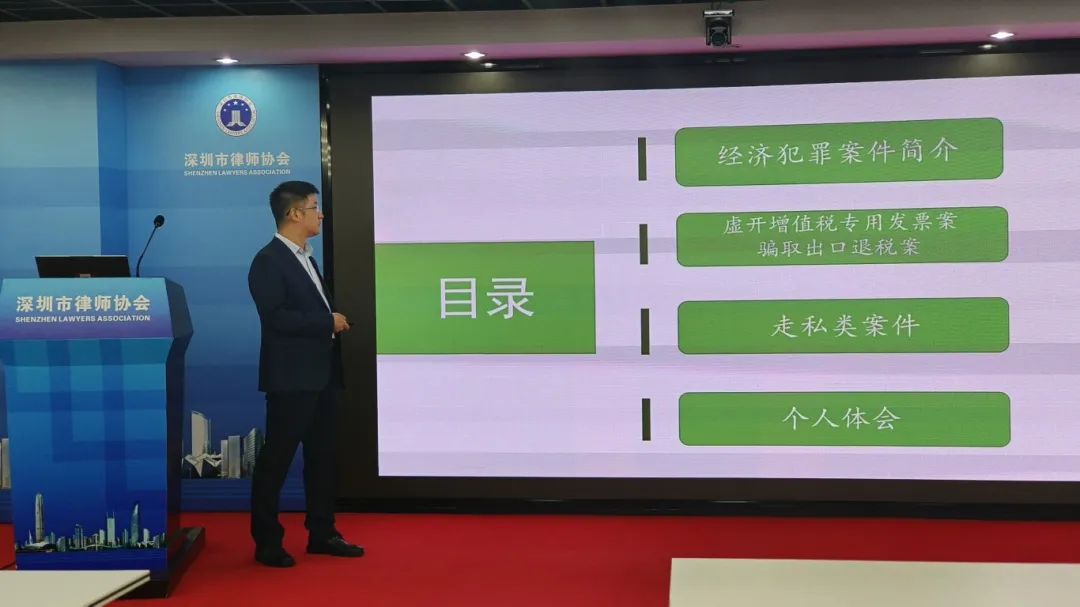

Based on his rich experience in handling tax-related and smuggling criminal cases, combined with relevant criminal laws and regulations, the content of judicial interpretation, various legal theories and judicial practice trends, etc., lawyer Han Ming mainly explained the brief introduction of economic crime cases, falsely issuing special value-added tax invoices, defrauding export tax rebate cases, smuggling cases, personal experience and other aspects, And shared the relevant experience of handling cases.

In the sharing part of "Introduction to Economic Crime Cases", considering the diversity of the participants' business directions, some of the audience were non-criminal lawyers. Lawyer Han Ming first briefly introduced the common types of economic crime cases and the corresponding jurisdiction units, and took a city as an example to sort out the general handling process of economic crime cases, and a large number of file pictures in a case of falsely issuing special VAT invoices intuitively show the huge "engineering quantity" of economic crime cases ".

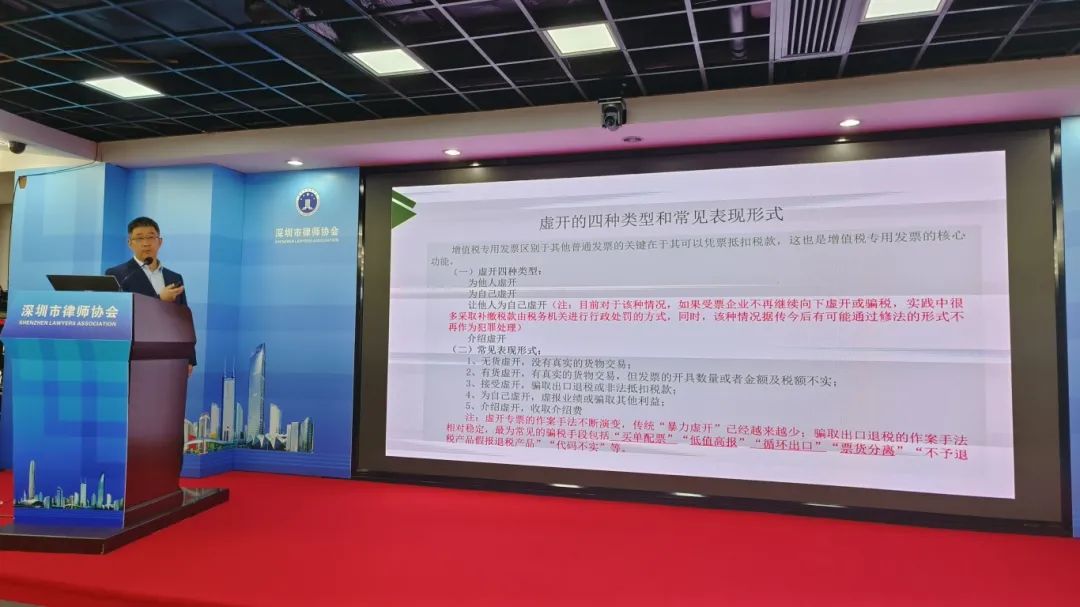

In the sharing part of "handling cases of falsely issuing special value-added tax invoices and defrauding export tax rebates", lawyer Han Ming believes that after the state has established a regular joint working mechanism to crack down on false tax fraud, coupled with the background of economic downturn, the number of tax-related criminal cases will rise significantly. At the same time, the Supreme People's Court and the Supreme People's Procuratorate jointly issued the "Interpretation on Several Issues Concerning the Application of Laws in Handling Criminal Cases Endangering Tax Collection and Administration" to falsely increase performance, financing, loans, etc., which are not the core functions of using special value-added tax invoices to offset taxes. The behavior of falsely issuing special value-added tax invoices is excluded from the crime of falsely issuing special value-added tax invoices, that is, this provides a broader space for lawyers to defend tax-related criminal cases.

Lawyer Han Ming briefly introduced the traditional paper special VAT invoices and the currently promoted digital electric invoices by way of illustration, explained the basic principles of false issuance of crimes, the four types and common manifestations of false issuance of special VAT invoices, and introduced the evolution process of false issuance of crimes in combination with years of case handling practice. Then, by showing the crime flow chart, this paper focuses on three classic false issuance of crimes: "Golden tickets", "tampering with customs tickets" and "violently falsely issuing" are then introduced to the current common or new types of false issuing methods: "falsely issuing invoices for agricultural products", "falsely issuing special tickets for electronic products" and "falsely issuing special tickets for information and technical service fees".

At the same time, lawyer Han Ming introduced the characteristics and difficulties of tax related criminal cases, as well as the introduction of the functional departments of the procuratorate and the court in handling tax related criminal cases and the division of jurisdiction in the first instance, and made an in-depth discussion and explanation on the tax related judicial interpretation issued by the two high and new courts. Lawyer Han also introduced in detail how criminals carried out false tax fraud activities through tax refund platform, ticket distribution platform, ticket distribution platform, ticket washing platform, etc. Finally, it focuses on 11 issues that need to be paid attention to in handling tax-related cases, such as whether "opening" and "opening" constitute a crime, issues that need to be paid attention to in key links such as distribution of goods and tickets, the profit model of tax-related parties, and lawyers handling tax-related cases. Detailed analysis and explanation were carried out on issues that need attention.

In the sharing part of "smuggling cases", lawyer Han Ming made a brief introduction to the types of smuggling such as customs clearance smuggling, bypass smuggling, indirect smuggling and follow-up smuggling, and elaborated on the prone groups and areas of common smuggling crimes such as smuggling of general goods, smuggling of drugs, smuggling of guns and ammunition, smuggling of precious metals, etc. As everyone has less contact with anti-smuggling work at ordinary times, anti-smuggling work has a certain mysterious color. Lawyer Han Ming also introduced basic common sense such as the jurisdiction of smuggling cases, the setting up and responsibilities of customs anti-smuggling departments, and introduced the smuggling crime process and main links in a more intuitive and vivid way by combining the schematic diagram of the smuggling crime process of common travel inspection channels and the schematic diagram of common links in smuggling cases. In addition, lawyer Han Ming also focused on one of the difficulties in smuggling cases: the crime of smuggling in processing trade, introduced the common modus operandi of smuggling in trade, and also introduced the new types of smuggling patterns that have emerged in recent years: fake cross-border e-commerce smuggling and fake border smuggling.

Finally, lawyer Han Ming put forward his own opinions on the common legal disputes in smuggling cases, such as the owner of the goods, the customs clearance personnel, the main accessory of the cargo collection personnel, the surrender problem, the unit crime problem, the price determination of the goods involved, etc., and shared the common five defense schemes in smuggling cases.

In the "personal experience" sharing part, lawyer Han Ming shared his personal experience in handling tax-related criminal cases and smuggling cases, such as key issues, common legal disputes, common defense plans, suggestions for amending relevant laws, etc. according to the relevant legal provisions and judicial interpretations issued by the state for tax-related criminal cases and smuggling cases, and his own experience in handling tax-related and smuggling cases.

- Lawyer Han Ming -

[Practice Introduction] Master of Law, full-time lawyer of Guangdong Shengdian Law Firm, director of the Criminal Defense Law Professional Committee, law professional practice teacher of Henan University of Technology, member of the Legal and Compliance Expert Committee of Shenzhen Garment Industry Association, Shenzhen Futian District People's Procuratorate Hearing member, hearing member of the People's Procuratorate of Shenzhen Shenshan Special Cooperation Zone, hearing member of the People's Procuratorate of Shenzhen Qianhai Shekou Free Trade Zone.He used to be the director of the legal affairs office of a listed company (A and B shares listed), the deputy chief of the Public Prosecution Section of a district people's Procuratorate, and the fourth-level senior prosecutor of the Public Prosecution Department of a city people's Procuratorate. He has been engaged in public prosecution (criminal prosecution) work in procuratorial organs for 16 years, during which he has made third-class meritorious service twice, and won the title of "Top Ten Public Prosecutors" of a city procuratorial organ.

[Practice Area] Criminal, Compliance and Wind Control, Civil and Commercial Dispute Resolution

[Contact Information] Phone:13632721665

E-mail:hanming@shengdian.com.cn