For more than ten years, Yu yi lawyers have carefully built a financial services team.

Since 2018, Shengdian Law Firm has begun to implement team reform and put forward the law firm development policy of "lean, standardized, professional and team-based. As a firm implementer of this development policy, Yuyi's lawyer team has made remarkable achievements in recent years, the team scale has been expanding, and the team's performance has made great progress.

At present, there are 16 lawyers in Yuyi's team, including 11 practicing lawyers (including 3 partner lawyers) and 5 trainee lawyers and assistants. Those who have the same desires from top to bottom win. As the backbone of the team, Yu Yi, a senior partner of Shengdian, gathers the core strength through team culture, gives full play to the advantages of the group to the greatest extent, continuously accumulates professional practical experience, forges a capable team, ensures the quality of cases and gains good reputation from customers.

As one of the earlier teams involved in the field of banking and financial services, Yuyi's lawyer team follows the model of "dedicated docking, team fighting, and process-based case handling", with high-level professional capabilities and high-level service awareness, for many commercial banks, AMC (Asset Management Company) and other financial institutions, Provide legal services in financial transactions and various complex structural asset management and disposal, there are many fans in Shenzhen's financial and judicial circles.

1. Experienced team leaders

If the lawyer team is regarded as a fleet of different levels, then the Yu Italian lawyer team can be said to be a heavy ship formation galloping through the law sea. It is facing the deep sea area of the market economy in the banking and financial fields. Cases often involve huge amounts of funds. Complex cases are like unpredictable weather on the sea. An experienced helm is very important. Yu Yi, a senior partner of Shengdian, is undoubtedly the helm of the fleet with outstanding record.

Lawyer Yu Yi has studied at China University of Political Science and Law and Peking University. The commercial banks, Asset Management Co., Ltd. (AMC) and other investment institutions entrusted to handle assets of more than 10 billion yuan, and participated in handling non-litigation and litigation, reorganization and There are thousands of mergers and acquisitions, with solid theoretical foundation and rich practical experience.

There are three main areas of practice for lawyers in Italy: first, the prevention and disposal of non-performing assets of commercial banks, Asset Management Co., Ltd. (AMC) and other financial institutions, the resolution and prevention and control of business risks and public opinion risks of financial institutions; The second is to provide buyers with due diligence, debt restructuring, creditor's rights acquisition, property value revitalization, etc. for asset management limited companies (AMC) and other investment institutions; third, the above-mentioned financial legal services in the process of cross-dispute resolution, financial activities in the criminal legal risk prevention and control.

At present, lawyer Yu yi mainly serves Shenzhen rural commercial bank, weizhong bank, Shenzhen branch of China development bank, China merchants bank, Zhuhai China resources bank co., ltd., Shenzhen branch of China cinda asset management co., ltd., Guangzhou asset management co., ltd., Shenzhen Nanshan baosheng village bank, Shenzhen Longgang dingye village bank, Shenzhen merchants ping an asset management co., ltd., guohe financial leasing (Shenzhen) co.) Co., Ltd., Shenzhen Asia Pacific Leasing Asset Trading Center Co., Ltd., Xiefeng Wanjia Technology (Shenzhen) Co., Ltd., Shenzhen Dazhen Barcode Technology Co., Ltd., Shenzhen Yihua Gongying Investment Co., Ltd., Shenzhen Aiboen Technology Co., Ltd., Shenzhen Huafuda Industrial Co., Ltd., Shenzhen Zhijin High-tech Financial Services Co., Ltd., Senze Financial Holdings (Shenzhen) Co., Ltd.

After more than ten years of industry cultivation, Yu Yilawyer has many fans in the financial and judicial circles of the Greater Bay Area by virtue of his outstanding business ability and customer reputation. He was successively invited by the Shenzhen Central Branch of the People's Bank of China, the Shenzhen Branch of China Merchants Bank Co., Ltd., the head office of Shenzhen Rural Commercial Bank and many branches to share practical experience as a guest speaker; he was also invited by the Shenzhen Credit Association to target various commercial banks The person in charge and backbone of the credit risk management department conducted legal training, and the response was excellent.

二、口碑至上的团队纲领

1. "Refuse to rush for quick success and instant benefits, advocate handshake and win-win cooperation, and establish a good industry reputation for customers while serving customers well."

In the process of handling non-performing asset cases of financial institutions, Yu yi's lawyer team found that except for a few debtors who owed money due to drug abuse, gambling and other bad habits, most of the debtors did not intentionally default, but encountered practical difficulties. the reasons for the arrears include but are not limited to cash flow chain disconnection, management decision-making mistakes, blind expansion of investment, failure to switch investments, etc. In view of this kind of debtor, Yu yi's lawyer team advocates shaking hands and realizing win-win cooperation. in the process of recovering creditor's rights, it assists the debtor to solve practical difficulties and finally realizes the entrustment purpose of the client.

Every non-performing loan case is taken seriously by Yu's team of lawyers. The realization of creditor's rights is the purpose and the settlement of litigation is the way. An investment group company due to the failure of investment in other industries led to the formation of a bad loan of about 50 million yuan in a commercial bank, the bad has a full amount of collateral to provide mortgage security, litigation, enforcement process, the debtor through the jurisdiction objection, appeal, enforcement objection and other procedures to delay the time, the purpose is to keep the collateral.

During the execution of the case, Yu's lawyer team applied to the court for auction on the one hand to exert pressure on the debtor through judicial auction, and on the other hand, in view of the actual difficulties of the debtor, it provided him with options that could solve the difficulties. Finally, the debtor accepted the suggestion of the lawyer team, reached a creditor's rights transfer agreement with the asset management company, purchased the bank's creditor's rights through the asset management company, and paid the asset company's expenses according to the agreement. The scheme not only solves the bank's non-performing loans, but also keeps the collateral for the debtor, achieving a win-win situation.

Yu Yi, Senior Partner of Shengdian

2. "To create value, control risks, and reduce losses as the program of action, adhere to the professional, efficient, and honest service concept, efficiently integrate various resources, and effectively solve customer practical problems."

Financial institutions and asset management companies are facing the current situation of long time limit for the recovery of non-performing asset claims, capital and assessment pressure. Overcoming obstacles quickly and achieving repayment as soon as possible is a challenge and an agency goal. In view of the different circumstances of each case, Yu's team of lawyers promptly controlled risks, deployed in advance, gave full play to their professional advantages, quickly and efficiently recovered claims, and helped clients reduce losses.

Shenzhen XXX Cultural Media Co., Ltd. owed more than 3000 million loans to a commercial bank (client) due to poor management. After accepting the entrustment, the Italian lawyer team immediately filed a lawsuit and preserved the collateral. After a close investigation of the company's movements, it was learned that the company's capital chain was broken, and the actual controller Huang was in debt and was detained by the public security organs on suspicion of criminal offences. In the litigation procedure, Yu yi's lawyer team communicated with Huang's criminal attorney for many times, and finally persuaded him to obtain Huang's authorization and participate in the litigation, and the first instance hearing went smoothly.

After the judgment came into effect, Yu's lawyer team immediately applied for execution and auction of the collateral, but at this time the company was no longer operating, and the official seal had been hidden by ordinary creditors, and the service of judicial documents became a problem. In order to solve the service problem, the team lawyer suggested to the executive court that the company's legal representative and shareholder Huang mou (holding more than 90% of the shares) be directly served. the executive judge accepted the suggestion and contacted Huang mou's criminal case trial judge to assist in the successful service.

In addition, the lease relationship on the collateral to be auctioned in the execution procedure is complex. Huang Moumou not only rented the collateral (five-storey factory building) for one room and two rents, but also the principal landlord sublet each floor to different merchants. The large number of tenants and the complicated lease relationship made it difficult to clear the premises and deliver the goods, which was extremely easy to be sold. Yu yi's lawyer team actively communicated with the principal landlord and obtained the evidence that the first lease had already expired. after communicating with the second lease tenant and surrounding investigation, it was found that the lease was not a real lease. At this point, the enforcement court agreed to auction without rent, greatly increasing the possibility of auction transactions.

After the announcement of the auction, the agent integrates resources to help find a strong buyer, eventually facilitating the auction of the collateral involved and realizing the recovery of the principal's claims.

3. Potential unlimited team elite

Yu yi's lawyer team has brought together many young elites, full of aggressiveness and drive. Most of these elites graduated from China University of Political Science and Law, Zhongnan University of Economics and Law, Southwest University of Political Science and Law and other domestic first-class law schools, with solid legal skills.

Many lawyers in the team also have work experience in public, procuratorial, legal and other institutions, with rich practical experience, and are good at handling various complex cases. The team members show their strengths and do their best in the advantageous business fields, constantly open up the business market, continuously improve the quality of legal services, and gradually make a name in the industry.

Lawyer Huang Lin Since practicing, for a number of listed companies and their subsidiaries, small and medium-sized enterprises, high net worth individuals to provide perennial legal advisory services. Hundreds of civil, commercial and criminal cases have been handled, of which many commercial litigation and arbitration cases have more than 10 million subjects, and more than 10 appeal cases have been revised or sent back for retrial. Acting for Shenzhen Rural Commercial Bank, China Resources Bank and other banks to handle the collection of non-performing assets, and has accumulated rich experience in the collection and enforcement of non-performing assets.

Lawyer Jia Yi Since its practice, it has handled more than 1,000 cases in total. He has successively handled litigation and enforcement of non-performing assets disposal cases for China Development Bank Shenzhen Branch, Shenzhen Rural Commercial Bank Co., Ltd., Zhuhai China Resources Bank Co., Ltd. and other banking institutions. For Shenzhen Asia Pacific Leasing Asset Trading Center Co., Ltd., Xiefeng Wanjia Technology (Shenzhen) Co., Ltd., Shenzhen Dazhen Bar Code Technology Co., Ltd. and other enterprises to provide perennial legal advisory services. It has also participated in a number of legal risk training sessions for small and medium-sized entrepreneurs.

Lawyer Yuan Jiyu Participated in the handling of hundreds of non-performing asset disposal cases by financial institutions such as Shenzhen Rural Commercial Bank Co., Ltd., China Development Bank, Shenzhen Qianhai Weizhong Bank Co., Ltd., Shenzhen Longgang Dingye Village Bank Co., Ltd., and the type of business involves loans, Factoring, bills, etc. Through litigation, execution, settlement, creditor's rights transfer, bankruptcy liquidation and other ways to recover hundreds of millions of yuan of non-performing assets for customers.

Lawyer Xiao Aiqin Participate in handling the collection of non-performing assets disposal cases of Shenzhen Rural Commercial Bank Co., Ltd., and have participated in more than 300 court hearings with an amount of more than 0.5 billion yuan. At the same time, he acted as an agent for the litigation, execution and bankruptcy liquidation of many cases of non-performing assets disposal of Shenzhen Longgang Dingye Village Bank Co., Ltd.

Lawyer Xiao Shuifeng Since its practice, it has collected more than 100 million yuan of claims for the principal through pre-litigation collection, settlement and execution. Participated in handling a number of non-performing asset disposal cases of financial institutions such as Shenzhen Rural Commercial Bank Co., Ltd., China Cinda Asset Management Co., Ltd. Shenzhen Branch, and accumulated rich experience in legal practices such as litigation, arbitration, and enforcement.

Lawyer Liu Chanmei He has handled litigation and execution of non-performing asset disposal cases such as Shenzhen Rural Commercial Bank Co., Ltd. and Shenzhen Qianhai Weizhong Bank Co., Ltd., with a total of more than hundreds of cases with an amount of more than 0.5 billion yuan. He has provided legal consulting services for legal counsel units, including reviewing various contracts and internal management systems, drafting legal opinions on the company's equity transfer, the company's equity incentive plan, the company's shareholders' meeting and board of directors, etc., and participated in a number of corporate litigation and arbitration cases.

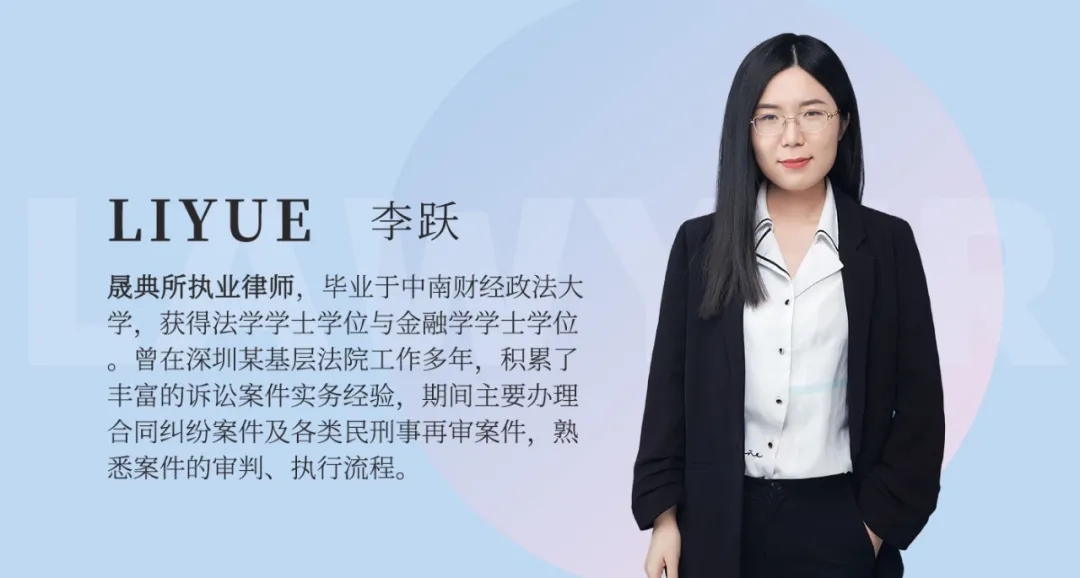

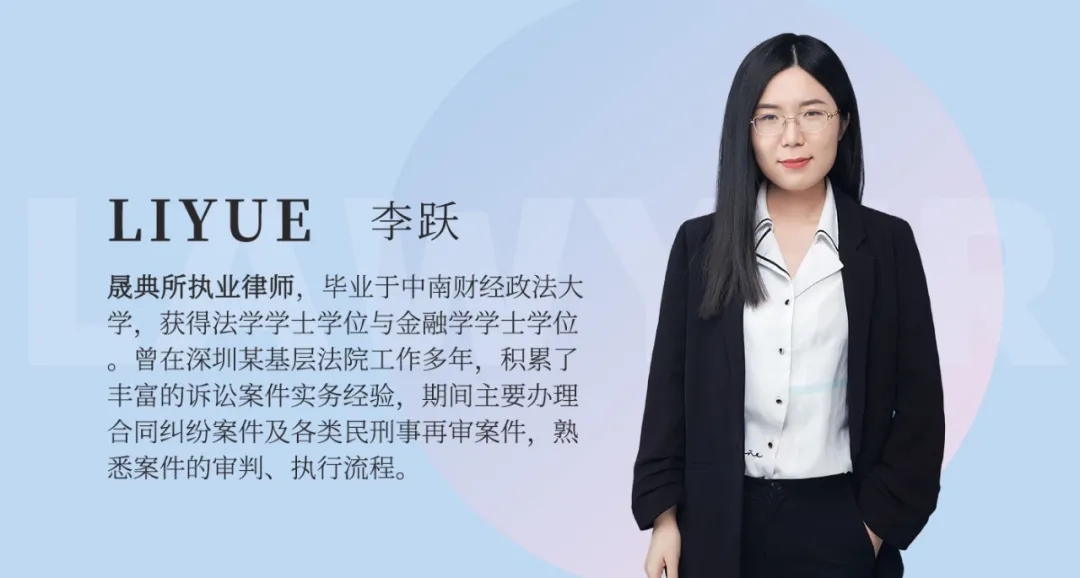

Lawyer Li Yue Joined Shengdian Law Firm in 2019, assisted the team in handling nearly 100 lawsuits and enforcement cases concerning the disposal of non-performing assets of Shenzhen Rural Commercial Bank Co., Ltd., provided legal consulting services for enterprises and financial institutions, and participated in a number of disputes over the return of original property, disputes over the right of recovery, and disputes over housing sales contracts.

Lawyer Liu HangMainly assist the team to deal with bank legal issues, issue legal opinions and various letters for the bank. Participate in handling hundreds of bank non-performing asset cases, submit litigation, arbitration, application for payment orders or notarization of creditor's rights to the competent court (or arbitration institution) in accordance with the law, establish the legality of creditor's rights through the judgment (or award) of the competent court (or arbitration institution), recover the creditor's rights according to the judgment or award, or recover the creditor's rights by relying on compulsory execution procedures (including settlement).

Lawyer Hao KunyuDuring the team's work, he participated in handling litigation and enforcement cases such as Shenzhen Rural Commercial Bank Co., Ltd., Shenzhen Nanshan Baosheng Village Bank Co., Ltd., and the disposal of bank asset packages of China Cinda Asset Management Co., Ltd. Shenzhen Branch.

Wang Qifan Intern Lawyer Now I assist the team in handling financial asset management and disposal business, provide legal advisory services for banks and non-bank financial institutions, and provide legal services such as due diligence, debt restructuring, debt acquisition and other legal services for handling financial assets, and have participated in many litigation and arbitration cases. Handle daily legal consultation and document drafting of consulting units, and participate in contract disputes, company disputes, marriage and family disputes.

Lin Sang Sang intern lawyer After graduating from university, he worked in a grass-roots court in Shenzhen. During his tenure as a judge assistant, he mainly assisted in handling loan contract disputes, labor disputes, copyright infringement disputes and other cases, and accumulated rich practical experience in civil litigation.

Lin Rongjin Trainee Lawyer I am currently assisting the team in handling litigation and execution of non-performing asset disposal cases of Shenzhen Rural Commercial Bank Co., Ltd. I have handled legal consultation, contract review and document drafting of the company's consultants, and participated in disputes in the contract field, disputes in the company field, and disputes in the real estate field.

Song Hiran as a trainee lawyer The main content of the work is to assist lawyers to review and modify contracts, assist lawyers in handling private loan disputes, traffic accident disputes, housing sales contract disputes and other cases, and assist lawyers in handling Shenzhen urban renewal projects, entering community workstations to preside over mediation work, etc.

Key achievements of 4. team in recent years

1, To help a partnership non-performing loan asset package acquisition, disposal project successful transaction, involving the amount of debt of more than 2.3 billion yuan.

2, To help an asset management company non-performing loan asset package acquisition, disposal project successful transaction, involving the amount of debt of more than 1.2 billion yuan. It provides customers with a full range of quality services in terms of designing transaction solutions and participating in transaction negotiations.

3, To help a debt enterprise financing and asset restructuring success, involving asset restructuring scale of more than 1.5 billion yuan, successfully help a commercial bank in six months to recover the non-performing loans, the amount of 0.18 billion yuan.

4. Provide non-performing loan disposal services for a commercial bank and more than 30 branches, and have been rated as the best service, best efficiency and best performance lawyer team for several consecutive years.

5, To help a well-known online bank in the financial supply chain factoring business, bill financing business and other non-performing assets disposal to provide full legal services, rapid recovery of nearly 30 million of non-performing loans.

6. Assist a commercial bank to successfully release the collateral and recover the arrears in full under the complicated circumstances of multiple waiting seizures by the court (some of which were seized by the land supervision department due to the existence of additional collateral; Some of them are waiting for seizure by foreign courts), the legal person of the enterprise in arrears is arrested on suspicion of illegally absorbing deposits, the enterprise in arrears is applied for bankruptcy by other creditors, and the collateral is maliciously occupied by a third party.

7, To help a commercial bank to recover a number of write-off class, pure guarantee class, no valid property clues class non-performing loans.

The team helped a commercial bank to find out the new executable property clues of the debtor through multi-channel understanding, field investigation and application for judicial detention when there was no executable property clues, and finally realized the creditor's rights in accordance with the law and effectively safeguarded the legitimate rights and interests of financial institutions.

8, To help a commercial bank successfully dispose of collateral, recovery of non-performing loans of more than 3000 million yuan.

The team helps commercial banks to dispose of non-performing assets, provides value-added legal services such as looking for prospective buyers of collateral, assisting bidders to participate in joint auctions and real estate transfers for commercial banks to realize their claims.

9, To help a commercial bank through a single complete debt transfer, recovery of non-performing loans of more than 6000 million yuan.

The team helps a commercial bank to transfer the creditor's rights to an asset company, recover the creditor's rights in full, and provide the commercial bank with full legal services in the first instance, second instance, execution and transfer of creditor's rights.

10. During the execution of a financial loan contract dispute case, the executor was successfully urged to voluntarily repay more than 4000 million yuan of debt.

In the course of the execution of a financial loan contract dispute case, the team searched for clues to the property of the executed person and found that there was a suspicion of transferring or concealing property, and forced the executed person to voluntarily repay the loan by exerting pressure.

![]() Loading...

Loading...![]() 2020.12.29

2020.12.29