The Main Difficulties and Outlets in the Practice of "Gambling Agreement" in the Post-"Nine Minmin Minutes" Era

![]() Loading...

Loading...

![]() 2022.11.24

2022.11.24

On the afternoon of November 20, 2022, the summit forum on "the main difficulties and ways out in the practice of" gambling agreement "in the post-Jiumin minutes era, sponsored by the law school of Guangzhou business school and shengdian law firm, was successfully held at No. 1 Pengcheng, 3rd floor, shentie real estate building, che kung temple, Futian district. Authoritative academic experts, senior judges from judicial practice departments, and authors of company law works who enjoy high popularity at home and abroad participated in the forum online. Wang Yongjing, director of Shengdian Law Firm, Zhou Hairong, senior partner, and Kou Xingming, senior partner, arrived at the forum to participate in the forum theme discussion. Online and offline more than 10,000 viewers listened to the forum in different ways. The forum was presided over by Zhu Ciyun, executive vice president of the Commercial Law Research Association of China Law Society, distinguished professor of Law School of Shenzhen University, and professor of Law School of Tsinghua University.

Opening Ceremony

First, Professor Zhu Ciyun presided over the opening ceremony, and Professor Zhao Jiaqi and lawyer Wang Yongjing delivered opening speeches.

(Opening group photo of participating experts and scholars)

Professor Zhao JiaqiI expressed my sincere gratitude to the guests who were invited to participate in the forum. He pointed out that this afternoon's forum will be a rare feast of academic research and trial experience. Then, on behalf of the Law School of Guangzhou Business School, he expressed his heartfelt congratulations on the 20th anniversary of Shengdian Institute. It is also the 20th anniversary of the establishment of the Law School of Guangzhou Business School, which can be described as the right time. After Professor Zhao Jiaqi introduced to us the founding cause, development process and achievements of the Law School of Guangzhou Business School, he wished the cooperation between the Law School of Guangzhou Business School and Shengdian Law Firm deeper in the future, and wished the summit forum a complete success.

(Dean and Professor of Law School of Guangzhou Business School: Zhao Jiaqi)

(Dean and Professor of Law School of Guangzhou Business School: Zhao Jiaqi)

(Director of Shengdian Law Firm: Wang Yongjing))

Theme Salon

(Attending experts and scholars delivered wonderful speeches)

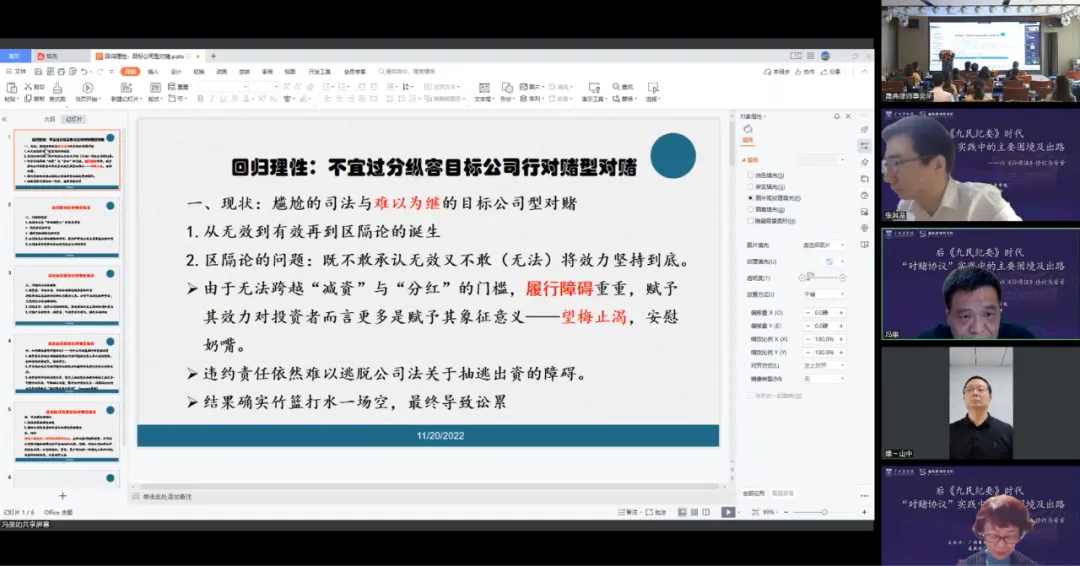

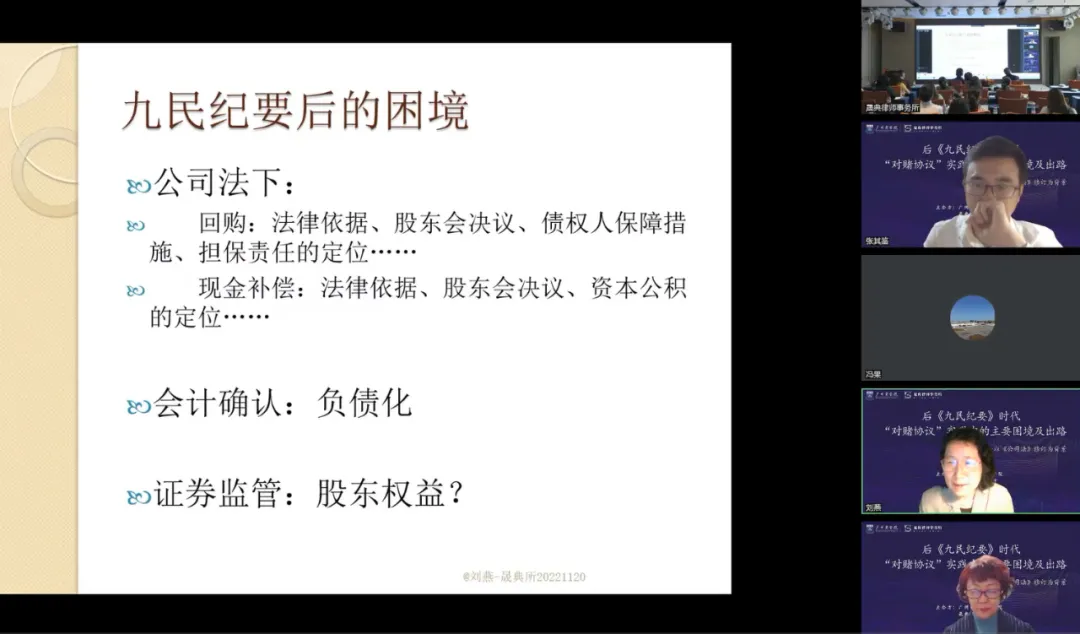

Professor Feng Guo summed up the current situation of the "gambling agreement" as "embarrassing judicial and unsustainable target company-type gambling", and pointed out that under the segmentation theory, there is a dilemma that the "gambling agreement" is legal and effective, but difficult to implement in practice. The conflict between the drawer agreement and the role of "yin and yang investors", the conflict between strict adherence to the contract and the company's right to survival and development, and the conflict between the company law's understanding of the effectiveness of capital reduction and dividend norms are the root causes of the problem. The "gambling agreement" originated from the commercial investment and financing needs of all parties, that is, the demand for stable income of shareholders into contractual obligations, but the freedom of contract should not bypass the regulation of company law and ignore the knowledge and participation of other stakeholders. Gambling investment should return to rationality, dialectical view of gambling investment, the target company-type gambling this model, should not be partial and connivance, the target company guarantee should not be easily supported, can not be because of the "gambling agreement" needs to cater to the company law amendment.

(Vice President of Economic Law Research Association of China Law Society, Dean and Professor of Law School of Wuhan University: Feng Guo)

Professor Liu Yan believes that in arbitration cases, arbitrators pay more attention to the autonomy of the parties, while court judges have the simple value concept of protecting the interests of creditors and capital maintenance, which makes this issue move from contract law to the context of company law. Under the company law, the legal basis involved in share repurchase, cash compensation, shareholders' meeting resolutions and other issues, these issues in the company law is not a big problem, the bigger problem is the "gambling agreement" liability accounting recognition caused by the securities regulatory issues. The Ninth Minute equates the "gambling agreement" with valuation adjustment, confusing valuation adjustment with maturity exit, and confusing equity transfer and equity repurchase under valuation adjustment. Valuation adjustment normally exists in three scenarios: PE/VC, major asset restructuring of listed companies, and overseas mergers and acquisitions. The latter two will not cause too many problems. Due to the uncertainty of the initial investment valuation, it is an international practice for PE/VC to inject multiple rounds of capital in stages, not a one-time capital injection in China, which makes the law in an awkward position. The most important thing about a complete PE/VC investment contract is a highly public company charter, so that creditors and others are aware of the content of the gambling agreement. In addition, whether PE/VC investment is equity or debt is an extremely important issue, and Xiaomi's financing story reflects the huge contrast caused by the different accounting treatment. In September 2022, the Ministry of Finance hammered out the recognition of the "gambling agreement" as a liability, raising the issue of securities regulation. Finally, Professor Liu Yan summarized "each in its own place, fair and square.

(Executive Director of Securities Law Research Association of China Law Society, Professor of Peking University Law School: Liu Yan)

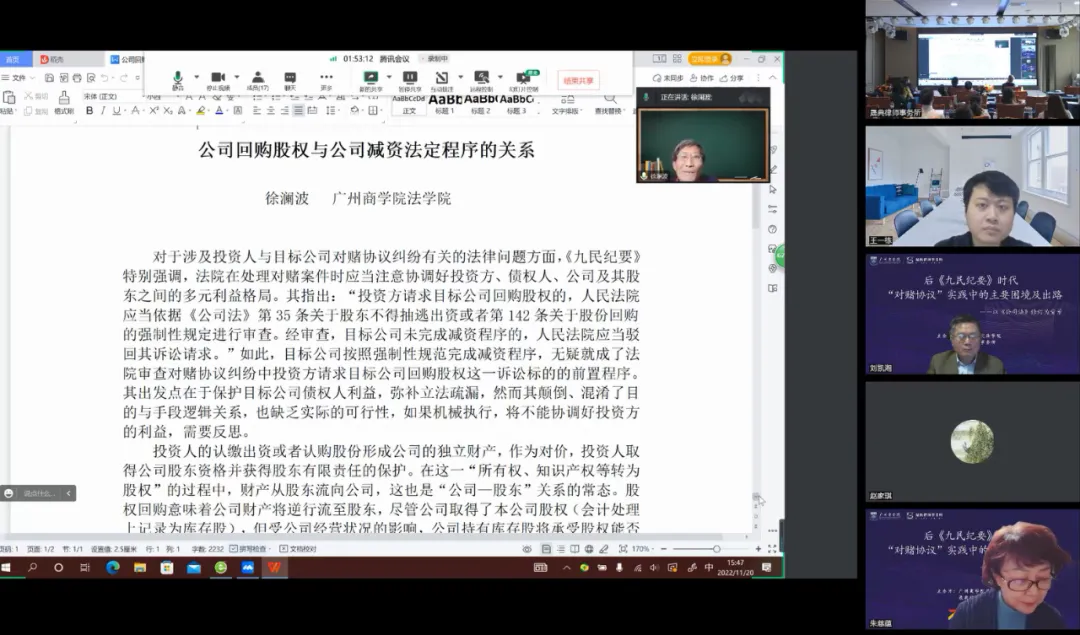

(Vice President of the Second Civil Division of Jiangsu Higher People's Court: Zou Yu)

Professor Xu Lanbo believes that the "Nine People's Minutes" requires the target company to complete the capital reduction procedure in accordance with mandatory norms, which reverses the logical relationship between purpose and means and lacks practical feasibility. The 2014 Companies Act removed the financial resource restriction on share buybacks, which was not conducive to creditor protection, so the Ninth Minute adopted the performance of the capital reduction procedure as a pre-procedure for share buybacks to close the legislative loophole. However, the Nine People's Minutes forcibly tied equity buybacks to capital reduction procedures, reversing the logical relationship between purpose and means. In addition, the rules that preceded the capital reduction procedure artificially created the contradiction between the contractual agreement and the company's unique organizational and power structure, legal compulsion and private law autonomy, and lacked practical significance. In short, there is no conditional relationship between the capital reduction procedure and the actual performance of the share repurchase agreement, and the statutory obstacle does not constitute a statutory exemption. As for the judgment rule that the target company must be "legally available funds" for share repurchase, and whether the "completion of the capital reduction procedure" can form the subject of litigation, it remains to be further clarified and refined by the judicial rules.

(Researcher, Institute of Law, Shanghai Academy of Social Sciences, Professor of Law School, Guangzhou Business School: Xu Lanbo)

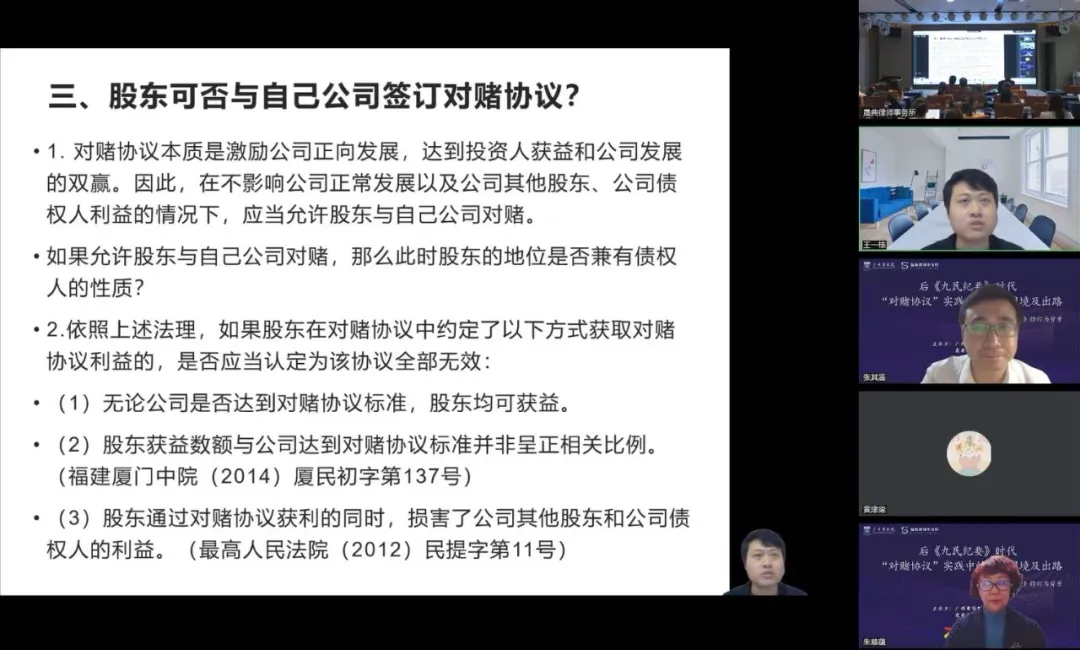

First of all, from the legal nature of the "gambling agreement", Wang Yidong, an associate researcher, analyzed whether there is a possibility of reasonable regulation of the "gambling agreement" under the existing framework of civil and commercial law, such as conditional contracts or lucky contracts. Under hypothesized conditions, conditional contracts can regulate "gambling agreements" of a special nature, such as multi-round gambling. Secondly, in the "gambling agreement" of equity financing, whether the agreement signed by the investor as a shareholder with the gambler may affect the independence of the company's legal personality. Third, the existing judicial practice seems to be the shareholders and the Company signed a "gambling agreement" that exists in the company's development of the actual fixed income and non-proportional income as detrimental to the interests of the company, other shareholders and creditors. Finally, from a legislative point of view, in the future revision of the Company Law involving the "gambling agreement", problems such as legal evasion caused by legal omnipotence should be avoided. On the basis of clarifying the basic problems (such as the dispute over stocks and debts, the necessity of pre-procedures for capital reduction, and the liability for breach of contract that cannot be reached by the "gambling agreement"), the scientific positioning of the "gambling agreement" in the legal rule system of our country should be re-ment.

(Associate Researcher, Institute of Corporate Compliance Management and Wind Control, Guangzhou Business School: Wang Yidong)

Vice President Zhang Wei mainly discussed the gambling in the investment agreement from the commercial aspect. He believes that the essence of gambling is the exit of private equity funds. There are three exit routes for private equity funds: the exit mechanism for shareholders of listed companies, Earn-out, and letting the company redeem itself. The "Huagong case" is actually a growth fund investment issue. The corporate debt of the target companies in which PE/VCs invest is small from a financial point of view, which is in line with business logic, as these enterprises are risky, lack liquidity and collateralizable assets, and have difficulty obtaining external loans. Therefore, if we want to make rules legally, we should jump out of the perspective of protecting the conflict between creditors and shareholders, and consider how we can maintain a balance between founders and investors and respect the autonomy of the parties. In addition, as to whether a company can make a bet after listing, he believes that the existence of a share circulation exit mechanism makes the bet meaningless. Finally, for the pre-repurchase of the capital reduction process, he believes that it can be solved by the pre-entrustment of the right to sell and the voting rights between shareholders.

(Associate Dean, Associate Professor, School of Law, Singapore Management University: Zhang Wei)

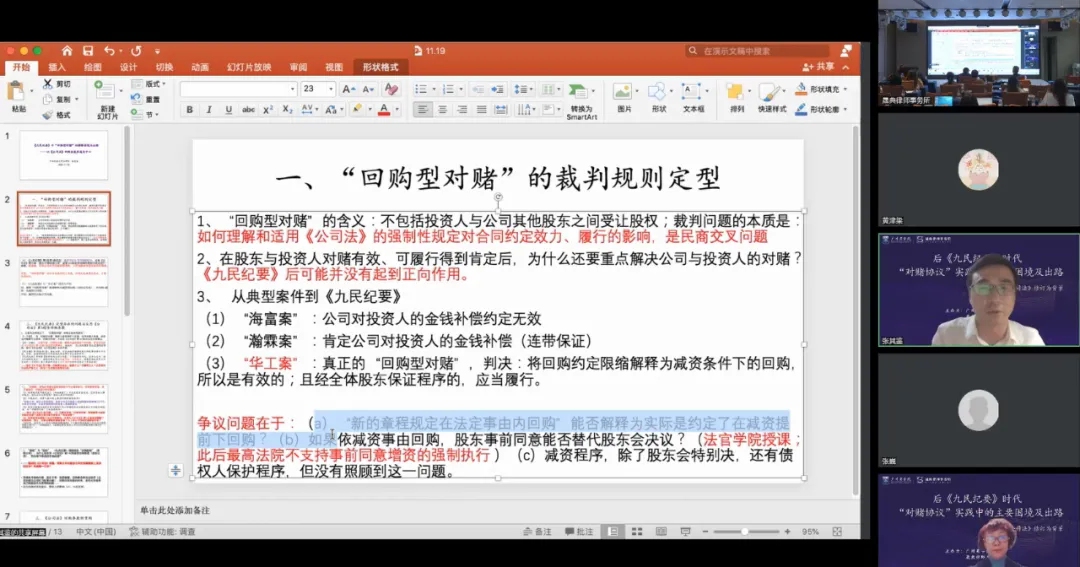

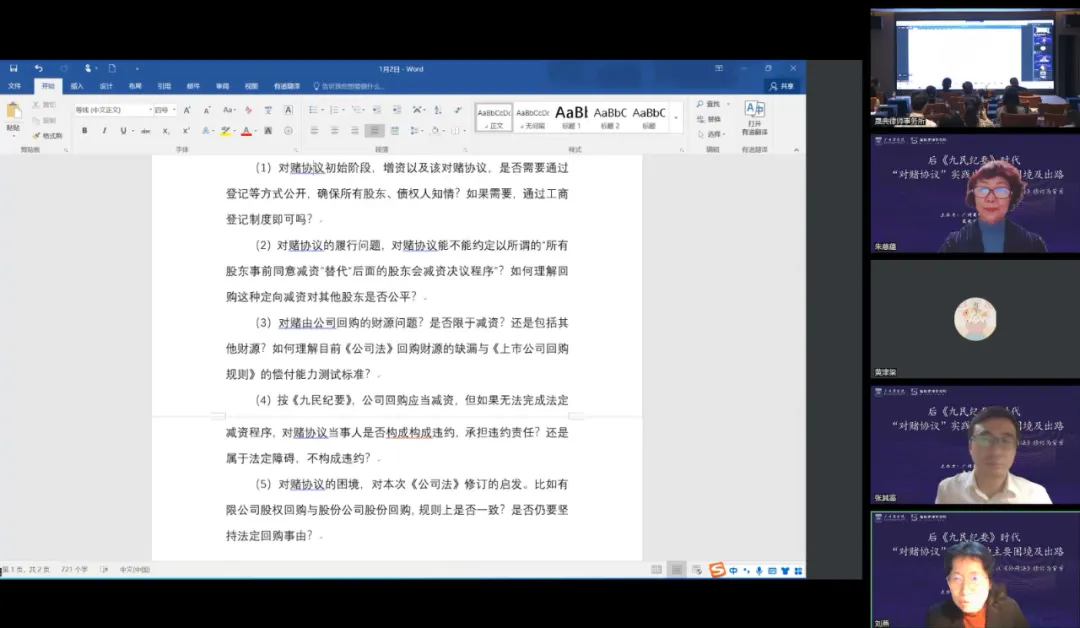

Dr. Zhang Qijian combed the rules of the "repurchase-type gambling" judgment, pointing out that the "Huagong case" and the "Nine People's Minutes" interpreted the "repurchase-type gambling" restriction as the root cause of the capital reduction-type gambling in Article 142 of the Company Law. After the Ninth Minute, even if the bet between the investor and the target company is valid in principle, the requirement must go through the capital reduction procedure before the execution can be requested, which leads to the problem of performance difficulties and further raises the issue of liability for breach of contract in the debt law, such as whether the statutory obstacle can become a statutory exemption. From the perspective of comparative law, there are three practices of abolitionism, moderation and strictness in the legal repurchase, and it is pointed out that the Company Law of our country is still a rare tendency of strictness, and there are problems of unfairness, narrowness and omission. In addition, it is proposed that the source of funds for the performance of "gambling agreements" should generally be limited by financial resources. Limited companies and non-public joint-stock companies in the repurchase rules, the "Company Law" level should be unified legislation, the special rules of listed companies by securities law, departmental regulations and so on. Finally, in view of the effectiveness of "repurchase-type gambling", financial resources restrictions, directional repurchase and procedural issues, the application of the repurchase provisions of the Company Law is envisaged.

(Assistant Professor, Law School, Central University for Nationalities: Zhang Qizhen)

Based on the "Haifu Case" and "Huagong Case" to the "Nine People's Minutes", Director Wang Yongjing pointed out that the concept and rules of the "gambling agreement" evolved from the concept of individual cases to the rules of adjudication. After the Ninth Minute, the "gambling agreement" is valid in accordance with the contract law, in line with the rules of the Company Law can be sued to perform the rules of the judgment is the "Ninth Minute" to the interests of the parties to the balance, but this will fall into the loss of invalid contract rules under the relief (contract negligence liability, remedial mechanism, etc.). The separate provisions of the Company Law on "no withdrawal of capital contributions" and "profit provisions" for limited companies and joint-stock companies have led to the mixing of "equity" and "shares" in the Ninth Minute, resulting in a mismatch between the Ninth Minute and the rules of the Company Law. In addition, he also raised the confusion of whether the statutory surplus reserve and arbitrary surplus reserve can be used for monetary compensation obligations, the lack of basis for compulsory distribution of profits to pay compensation, and the rationale for judicial decisions to replace the company's statutory procedures, discussed the impact of the "simplified capital reduction" procedure in the revision of the Company Law on the monetary compensation obligations of the "gambling agreement", and pointed out that the performance of the "gambling agreement" and its effectiveness should be returned to shareholders.

(Director of Shengdian Law Firm: Wang Yongjing)

Lawyer Zhou Hairong demonstrated the court's judicial attitude towards "effective gambling between shareholders and invalid gambling between shareholders and target companies" after the "Haifu case" and before the "Jiumin Minutes" by giving examples of real gambling cases undertaken by himself. Before the "Jiumin Minutes" was issued, how the judgment rules of the "Haifu Case" profoundly affected the determination of the validity of the "gambling agreement" by the people's courts at all levels. It affirmed the high-level landmark judgment of Jiangsu Provincial High Court in the "Huagong case", and praised the "nine people's minutes" issued by the Supreme Court for transforming the past "one size fits all" into conditional affirmation. Although the "Company Law" and the "Nine People's Minutes" have made specific rules for the company's capital reduction, it is still a legislative gap for the company's shareholders to agree to refund their capital, and put forward their own views and suggestions. Finally, lawyer Zhou Hairong once again praised the "Huagong case" and believed that legislation and justice should fully respect the autonomy of the parties in the "gambling agreement", which is also a manifestation of respecting the objective laws and practices of business.

(Senior Partner of Shengdian Law Firm: Zhou Hairong)

Lawyer Kou Xingming analyzed the practical risks of the "gambling agreement" from the perspective of the dilemma of the time dimension, the area of frequent disputes, and the boundary with the surrounding legal or commercial relations. The legislative reasons for the relative lag of legislation, the reverse of judicial interpretation, the lack of legislative technology, and the market and regulatory reasons are the main reasons for the above-mentioned risks. Looking forward to the future development of the legal rules of the "gambling agreement", we should return to the basic principles of meaning autonomy, the basic value order of traditional civil law (upper and lower relations, internal and external relations), the fine pursuit of individual cases, and dynamic balance (the time node publicity system of responsibility division, the notice system, the decision-making avoidance mechanism, etc.).

(Senior Partner of Shengdian Law Firm: Kou Xingming)

Free discussion

Questions and communication

Closing Ceremony

Director wang yongjing delivered a closing speech. He noted that the topics covered at the Forum were very important in both the legal and financial communities. At this conference, experts and scholars have a high perspective, profound thinking and full discussion. The content of the conference is rich and the result is satisfactory. The insights and insights of today's experts and scholars have provided great help to our lawyers present and online in guiding the judicial practice related to the "gambling agreement" and our legal service practice. He said that the academic knowledge sharing forum held by experts and scholars has added bright color to the 20th anniversary of Shengdian law firm and the 20th anniversary of Law School of Guangzhou Business School. After that, Director Wang Yongjing felt very honored to be able to discuss hot and difficult issues with experts and scholars who participated in the revision of the Company Law and the formulation of judicial interpretations in the future. This is a manifestation of contributing to society's participation in the rule of law, judicial progress, and honor.

(Director of Shengdian Law Firm: Wang Yongjing)