According to the" Securities Daily "report, on the afternoon of March 20, the annual shareholders meeting of the listed company Flush (stock code: 300033) was held in Hangzhou. Flush management responded for the first time to the core employee stock ownership platform" tax compensation storm. According to the report, the reporter learned from people familiar with the matter that in November 2022, Shanghai Caishio Information Consulting Center (Limited Partnership) (hereinafter referred to as "Caishio") received the "Notice on Tax Matters" from the Shanghai Baoshan Branch of the State Administration of Taxation., The notice stated that it was "suspected of failing to declare and pay taxes in the process of changing the organization form" and required to pay 2.5 billion yuan in taxes. This incident has attracted great attention from all parties, and this paper attempts to sort out the context and logic of the incident from a tax perspective.

according to the contents of the state enterprise trust system, enterprise check and flush announcement:

-

On August 24, 2007, Keso was established in Shanghai as a limited liability company.

-

On August 30, 2007, the original shareholders of Flush Shun transferred a total of 20% of their equity to Kesho in order to motivate the backbone of the business and key management personnel.

-

On December 25, 2009, Flush was listed on the Shenzhen Stock Exchange Growth Enterprise Market. According to the contents of the IPO "Prospectus" of Flush: Keschio promises to fulfill the 12-month lock-up period after listing, and after the end of the lock-up period, the annual transfer of shares shall not exceed 25% of the total number of Flush shares held.

-

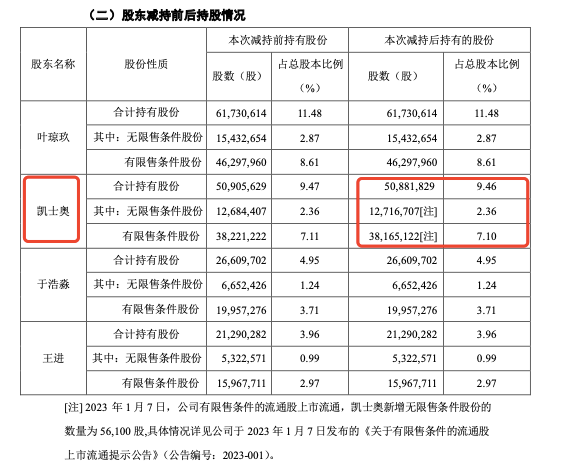

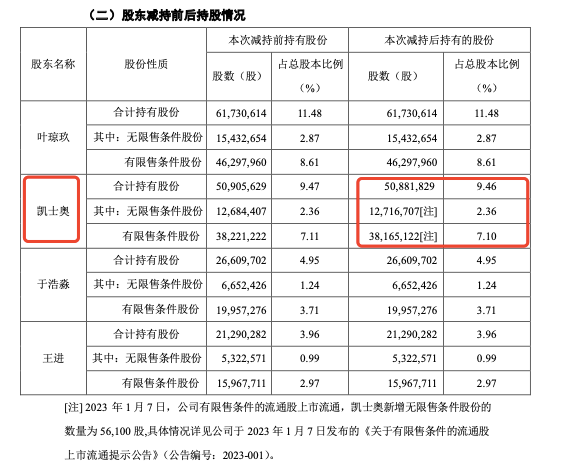

At present, Ceso is the third largest shareholder of Flush, holding 9.46 per cent of the shares and seven natural partners, all of whom are employees of Flush.

-

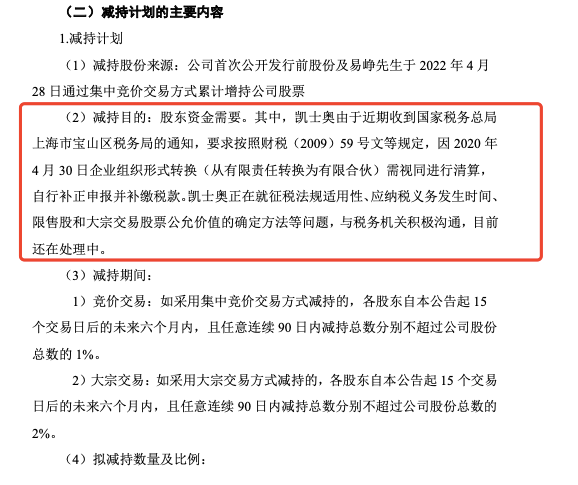

Among them, the most important is to move to Beijing in March 2020, the following month, it was converted from a limited liability company to a limited partnership. In June of the same year, it moved back to Shanghai in the form of a limited partnership and changed its name to Shanghai Kaishio Information Consulting Center (Limited Partnership). according to the following changes in organization form, announcement no. 041, 2021-021, keso is still reducing its holdings of unlimited conditional shares.

It is precisely because of the cross-regional" transformation of the "company into a partnership" that the Shanghai Tax Bureau believes that Kasseo "is suspected of failing to declare and pay taxes in the process of changing the form of organization" and has to pay a huge amount of back tax. The author believes that the following four issues are worth discussing:

First: Why the change in organizational form?

Second: Is such a change in organizational form legal?

Third: What is the rationale for the back tax claim?

Fourth: What are the consequences?

first: why the change in organizational form?

In addition to flush, there are many cases in which listed companies have converted their shareholding platforms from companies to partnerships, such as Allianth Sharp (stock code: 301042) and Etian (stock code: 300812). The tax advantages of the transformation are:

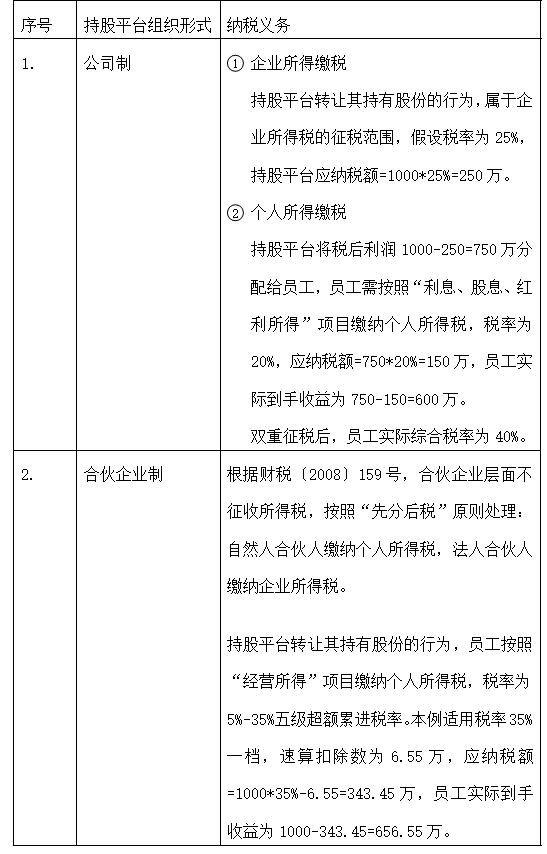

(1) The external transfer of shares by the shareholding platform is subject to a lower tax burden in the form of a partnership.

For example, a holding platform transfers unlimited conditional shares to obtain 10 million income, because the holding platform basically has no substantive business operations, do not consider other costs and expenses. The tax payment results of different organizational forms are analyzed as follows:

it can be seen that the same transaction, the choice of partnership system will make employees get more income.

(2) Previously, local governments and tax bureaus may introduce special preferential policies, such as financial incentives, approved personal income tax, etc., so that employees of shareholding platforms can enjoy a lower comprehensive tax burden.

second: is this kind of organizational change legal?

Currently, there is no specific legal basis for converting a company into a partnership. In our country, the company belongs to the legal person organization, can bear civil liability independently, while the partnership is the opposite, the two are regulated by the Company Law and the Partnership Law respectively.

So, the transformation of a company into a partnership actually spans two laws and there are two legal facts, namely: 鈶?the company is liquidated and written off; 鈶?the shareholders use the proceeds of liquidation to establish a new partnership. Thus, the registration rights granted by law to the industrial and commercial authorities are: cancellation of registration and establishment of registration.

However, in practice, some places have explored and introduced some policies to support the registration of changes for the purpose of attracting investment. For example, the Beijing Administration for Industry and Commerce's "Trial Measures for the Registration of the Transformation of Enterprise Organization Forms in Zhongguancun National Independent Innovation Demonstration Zone" (Beijing Industry and Commerce 2010 No. 131), and the Xinjiang Administration for Industry and Commerce issued the "Xinjiang Administration for Industry and Commerce on the Change of Limited Liability Companies" Guiding Opinions on Partnership Enterprises "(New Industry and Commerce Enterprise 2010 No. 172), etc., as long as the required information is submitted, the company can be directly changed to a partnership enterprise.

3rd: What is the rationale for the back tax claim?

According to Article 4, Paragraph (I) of the" Notice on Several Issues Concerning the Treatment of Enterprise Income Tax on Enterprise Restructuring Business "No. 59 of Caishui [2009]," An enterprise is transformed from a legal person into an unincorporated organization such as a sole proprietorship enterprise or a partnership enterprise. Or if the registered place is transferred outside the the People's Republic of China (including Hong Kong, Macao and Taiwan), the enterprise shall be liquidated and distributed, and shareholders reinvest to establish a new enterprise. All of the assets of the enterprise and the tax basis of the shareholder's investment should be determined on the basis of fair value." Therefore, when the shareholding platform is transformed from a company to a partnership, the original company should be treated as liquidation, and the shares of the listed company held by it should be determined at fair value to determine the profit and loss on disposal and pay corporate income tax; secondly, the profits after liquidation should be distributed to employees, who should pay personal income tax. The closing price on the day of the completion of the organizational change was 119.45 yuan/share, the number of shares held was 50.9156 million shares (including restricted shares), and the total fair value was 6.082 billion yuan. According to the above case description, the total amount of double tax payment was 60.82*40%= 2.433 billion yuan.

Obviously, Cesar did not declare tax when he completed the transformation in Beijing, and is now required by the Shanghai Tax Bureau to make up the tax. On the one hand, it reflects that the tax authorities and the industrial and commercial authorities have not achieved a better linkage and there are regulatory loopholes. On the other hand, it also reflects that taxpayers need to be more cautious in understanding and applying regional policies. In addition, the corporate shareholding platform has been canceled, and it is worth thinking about who will be responsible for the part of the corporate income tax that should be paid.

Fourth: What are the consequences?

For the core staff of the flush, such a result is undoubtedly a bolt from the blue. The change of organizational form has not achieved the expected effect. In the absence of cash inflow, it also bears a large tax obligation in advance. According to the latest announcement of Tonghua Shun, Keso currently holds 50,881,829 shares, of which 12,716,707 are unrestricted shares. According to the closing price of 176.33 yuan/share on March 29, the total value of the transferable shares of CASO is 2.24 billion yuan, which is still lower than the amount of supplementary tax.

In addition, according to Article 63 of the Tax Collection Act, failure to declare the change of organizational form may result in employees (former shareholders of the holding platform) being found to have committed tax evasion, and the tax authorities shall have the right to recover the taxes and late fees not paid or underpaid, and impose a fine of not less than 50% and not more than five times the taxes not paid or underpaid. If the tax authorities impose administrative penalties on them and the employees fail to pay in full and on time, the provisions of Article 201 of the Criminal Law on the crime of tax evasion will be triggered. At that time, the employees cannot avoid criminal responsibility by the first exemption rule in paragraph 4. However, can the tax liability of a corporate enterprise be pursued by shareholders who are not involved in controlling and operating? Can tax and penalty liability break through the principle of limited liability of shareholders? In our view, it is not without controversy.

according to the securities daily, flush held its 2022 annual performance briefing on the afternoon of March 27. In an interview with reporters, Flush executives said: "Over the years, the income from the sale of shares has only been more than 0.3 billion yuan, which is far less than the tax and late fees to be levied. Therefore, this sudden huge tax is like a mountain, making it impossible for enterprises to bear it." "Keso is an employee shareholding platform, and in the event that restricted shares cannot be sold, Keso cannot raise enough funds to pay taxes in full and on time. The company is paying close attention to the ideological trends of core employees, doing its best to communicate with employees, convey the care of government departments at all levels, and make timely responses to issues of concern to core employees, and strive to maintain the normal operation of the company and the stability of corporate governance."

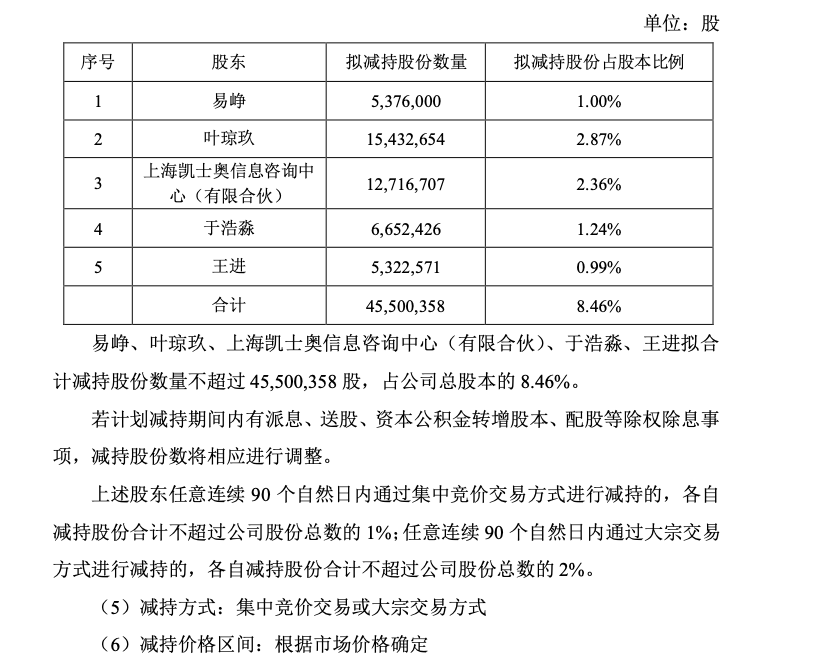

On the evening of March 27, flush announced that due to the need for shareholders' funds, yi Zheng, the company's actual controller, chairman and general manager, and ye Qiong, director and deputy general manager, shanghai Kaishio Information Consulting Company, a shareholder holding more than 5% of the shares, and the company's directors Yu Haomiao and Wang Jin, intend to reduce their holdings by means of centralized bidding or block trading within 6 months after 15 trading days from the date of the announcement, accounting for 8.46 of the company's total share capital.

Equity incentive has a positive and significant effect on improving the company's management efficiency and enhancing cohesion. More and more companies want to introduce. However, equity incentive from the establishment to the operation, is a long-term and professional work.

flush employee stock ownership platform is deeply involved in tax turmoil due to the change of organizational form. both employees and flush are affected to varying degrees. The choice of shareholding platform is only part of the tax planning of equity incentive, and the partnership form is not always the best choice for the holding platform for different purposes. How should employees pay personal tax when exercising their rights? Can the deferred tax policy apply to the reduction of employee shareholding platform holdings? Can the employee's external transfer of shares of the holding platform be subject to the "transfer of property income" item to pay a tax, and can the internal transfer of shares be exempt from a tax? There are a number of issues that need to be considered in the early stages of establishment. Therefore, it is recommended that enterprises make comprehensive tax assessment and tax compliance arrangements in the early stage of the introduction of equity incentives to reduce subsequent tax-related risks.

(Author's opinion only)

guidance and approval: Wang Yongjing

senior partner of shengdian law firm, director of shengdian tax law research center, registered lawyer of hong kong kewushen law firm (ONC) (Chinese law), arbitrator of south China international economic and trade arbitration commission (Shenzhen international arbitration court), expert of third-party supervision and evaluation mechanism of compliance of enterprises involved in Guangdong province, instructor of master's degree in legal cooperation of central south university of economics and law, off-campus tutor of Master of Law from Law School of Shenzhen University, member of Tax Law Professional Committee of All China Lawyers Association, deputy director of Tax Law Professional Committee of Guangdong Lawyers Association, and high-end tax talents in the first phase of China Certified Tax Agents Association (60 nationwide). Master of Accounting and Doctor of Law from Wuhan University, holds professional qualifications such as lawyer, accountant, certified tax accountant, Australian public accountant, certified asset appraiser, real estate appraiser, certified consulting engineer, financial economist, securities and fund practitioner.

Key practice areas :

corporate practices such as acquisition, merger and reorganization; Civil and commercial dispute resolution (litigation, arbitration and negotiation mediation); Tax law and taxation (compliance, planning, inspection response, reconsideration and litigation); Comprehensive legal and tax consultant (perennial and special); Investment and financing (VC, PE, large capital management); Cross-border commercial transactions and dispute resolution; real estate and construction projects.

Email:

wangyongjing@shengdian.com.cn

creation and writing: Cao wenwen

practice lawyer of shengdian law firm, member of shengdian tax law research center, Chinese tax agent. He has served in a large foreign financial leasing company and served as the legal department of the company's headquarters.

Key practice areas:

non-litigation matters such as mergers and acquisitions, tax law and taxation, capital markets and related dispute resolution.

Email:

caowenwen@shengdian.com.cn

![]() Loading...

Loading...![]() 2023.03.31

2023.03.31